- Home

- AACE International

- Certified Cost Professional (CCP) Exam

- AACEInternational.CCP.v2025-04-12.q75

- Question 60

Valid CCP Dumps shared by ExamDiscuss.com for Helping Passing CCP Exam! ExamDiscuss.com now offer the newest CCP exam dumps, the ExamDiscuss.com CCP exam questions have been updated and answers have been corrected get the newest ExamDiscuss.com CCP dumps with Test Engine here:

Access CCP Dumps Premium Version

(189 Q&As Dumps, 35%OFF Special Discount Code: freecram)

<< Prev Question Next Question >>

Question 60/75

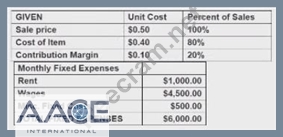

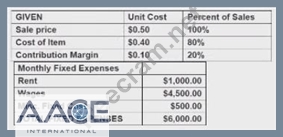

As the leas cost engineer for the XYZ Services Company, you have been requested to provide pertinent for an equipment rental decision. The unit price of the food stuffs varies, but an average unit selling process has been determined to be $0.50 cents and the average unit acquisition cost is $0.40 cents.

The following revenue and expense relationships are predicted:

It S480 is the target net profit, then the total sales volume (in dollars) is:

The following revenue and expense relationships are predicted:

It S480 is the target net profit, then the total sales volume (in dollars) is:

Correct Answer: B

To calculate the total sales volume needed to achieve a target net profit of $480, we first find the total required contribution margin:

Required Contribution Margin=Fixed Costs+Target Net Profit=6,000+480=6,480\text{Required Contribution Margin} = \text{Fixed Costs} + \text{Target Net Profit} = 6,000 + 480 = 6,480Required Contribution Margin=Fixed Costs+Target Net Profit=6,000+480=6,480 Using the contribution margin per unit of $0.10, we calculate the required sales volume:

Required Sales Units=6,4800.10=64,800 units\text{Required Sales Units} = \frac{6,480}{0.10} = 64,800 \text{ units}Required Sales Units=0.106,480=64,800 units Then, multiply by the unit sale price:

Total Sales Volume=64,800×0.50=$32,400\text{Total Sales Volume} = 64,800 \times 0.50 = \$32,400Total Sales Volume=64,800×0.50=$32,400 Therefore, $32,400 is the required sales volume to achieve a target net profit of $480.

Required Contribution Margin=Fixed Costs+Target Net Profit=6,000+480=6,480\text{Required Contribution Margin} = \text{Fixed Costs} + \text{Target Net Profit} = 6,000 + 480 = 6,480Required Contribution Margin=Fixed Costs+Target Net Profit=6,000+480=6,480 Using the contribution margin per unit of $0.10, we calculate the required sales volume:

Required Sales Units=6,4800.10=64,800 units\text{Required Sales Units} = \frac{6,480}{0.10} = 64,800 \text{ units}Required Sales Units=0.106,480=64,800 units Then, multiply by the unit sale price:

Total Sales Volume=64,800×0.50=$32,400\text{Total Sales Volume} = 64,800 \times 0.50 = \$32,400Total Sales Volume=64,800×0.50=$32,400 Therefore, $32,400 is the required sales volume to achieve a target net profit of $480.

- Question List (75q)

- Question 1: A used concrete pumping truck can be purchased for $125,000....

- Question 2: In order to withdraw $400 at the end of each year for seven ...

- Question 3: Money is value Having money when you need it is very importa...

- Question 4: A used concrete pumping truck can be purchased for $125,000....

- Question 5: Money is value. Having money when you need it is very import...

- Question 6: What is a basic element of work or a task that must be perfo...

- Question 7: A used concrete pumping truck can be purchased for $125,000....

- Question 8: Budgeted cost of work scheduled is all of the following exce...

- Question 9: Which of the following is NOT an aspect of quality managemen...

- Question 10: An agricultural corporation that paid 53% in income tax want...

- Question 11: An agricultural corporation that paid 53% in income tax want...

- Question 12: The latest allowable end time minus the earliest allowable e...

- Question 13: An agricultural corporation that paid 53% in income tax want...

- Question 14: A used concrete pumping truck can be purchased for $125,000....

- Question 15: Which of the following are used for profitability analysis i...

- Question 16: A major theme park is expanding the existing facility over a...

- Question 17: The following question requires your selection of CCC/CCE Sc...

- Question 18: When a person hears the words being said to him/her, but doe...

- Question 19: A major theme park is expanding the existing facility over a...

- Question 20: Which of the following is used for measuring productivity lo...

- Question 21: The following question requires your selection of CCC/CCE Sc...

- Question 22: The following question requires your selection of CCC/CCE Sc...

- Question 23: Money is value. Having money when you need it is very import...

- Question 24: The goal of listening is to:

- Question 25: A used concrete pumping truck can be purchased for $125,000....

- Question 26: An agricultural corporation that paid 53% in income tax want...

- Question 27: A major theme park is expanding the existing facility over a...

- Question 28: The following question requires your selection of CCC/CCE Sc...

- Question 29: If two alternatives with different useful lives are to be co...

- Question 30: An agricultural corporation that paid 53% in income tax want...

- Question 31: How can the quality of a cost/capacity factor estimate be im...

- Question 32: Which of the following best describes the three key particip...

- Question 33: Two of the most important things to know when planning a spe...

- Question 34: An American company plans to acquire a new press machine fro...

- Question 35: The following question requires your selection of CCC/CCE Sc...

- Question 36: The following question requires your selection of CCC/CCE Sc...

- Question 37: Which of the following is NOT a part of the five (5) phases ...

- Question 38: Which of the following is NOT an advantage specific to a cos...

- Question 39: An American company plans to acquire a new press machine fro...

- Question 40: SCENARIO: A can manufacturing company requested you to provi...

- Question 41: Money is value. Having money when you need it is very import...

- Question 42: You are reporting the following Earned Value Analysis inform...

- Question 43: A used concrete pumping truck can be purchased for $125,000....

- Question 44: Which of the following is NOT a type of float?...

- Question 45: A major theme park is expanding the existing facility over a...

- Question 46: The following question requires your selection of CCC/CCE Sc...

- Question 47: An agricultural corporation that paid 53% in income tax want...

- Question 48: A used concrete pumping truck can be purchased for $125,000....

- Question 49: An American company plans to acquire a new press machine fro...

- Question 50: A small hole construction project has a baseline budget of $...

- Question 51: A used concrete pumping truck can be purchased for $125,000....

- Question 52: ______________can be defined as the determination of that co...

- Question 53: When the project plan is implemented:...

- Question 54: The following question requires your selection of CCC/CCE Sc...

- Question 55: In the application of the benefit/cost method of analysis, w...

- Question 56: When measuring progress using tasks that lack readily defina...

- Question 57: Which statement best describes the constructability review f...

- Question 58: A major theme park is expanding the existing facility over a...

- Question 59: A major theme park is expanding the existing facility over a...

- Question 60: As the leas cost engineer for the XYZ Services Company, you ...

- Question 61: A small hole construction project has a baseline budget of $...

- Question 62: A major theme park is expanding the existing facility over a...

- Question 63: A used concrete pumping truck can be purchased for $125,000....

- Question 64: A major theme park is expanding the existing facility over a...

- Question 65: ____________is defined as the earned work hours or dollars f...

- Question 66: An agricultural corporation that paid 53% in income tax want...

- Question 67: The following question requires your selection of CCC/CCE Sc...

- Question 68: Some of the principles of good communication are:...

- Question 69: A major theme park is expanding the existing facility over a...

- Question 70: Money is value. Having money when you need it is very import...

- Question 71: A used concrete pumping truck can be purchased for $125,000....

- Question 72: A major theme park is expanding the existing facility over a...

- Question 73: A major theme park is expanding the existing facility over a...

- Question 74: A major theme park is expanding the existing facility over a...

- Question 75: A used concrete pumping truck can be purchased for $125,000....

[×]

Download PDF File

Enter your email address to download AACEInternational.CCP.v2025-04-12.q75.pdf