Valid 2016-FRR Dumps shared by ExamDiscuss.com for Helping Passing 2016-FRR Exam! ExamDiscuss.com now offer the newest 2016-FRR exam dumps, the ExamDiscuss.com 2016-FRR exam questions have been updated and answers have been corrected get the newest ExamDiscuss.com 2016-FRR dumps with Test Engine here:

Access 2016-FRR Dumps Premium Version

(390 Q&As Dumps, 35%OFF Special Discount Code: freecram)

<< Prev Question Next Question >>

Question 109/145

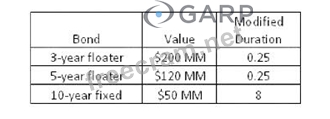

A bank owns a portfolio of bonds whose composition is shown below.

What is the modified duration of the portfolio?

What is the modified duration of the portfolio?

Correct Answer: D

* Calculate the weighted average of modified durations:

* The modified duration of the portfolio is a weighted average of the durations of the individual bonds, where the weights are the proportions of the total portfolio value.

* Calculate the total value of the portfolio: $200 MM (3-year floater) + $120 MM (5-year floater) +

$50 MM (10-year fixed) = $370 MM.

* Calculate the weights for each bond:

* 3-year floater: $200 MM / $370 MM = 0.5405

* 5-year floater: $120 MM / $370 MM = 0.3243

* 10-year fixed: $50 MM / $370 MM = 0.1351

* Multiply each bond's weight by its modified duration and sum the results:

* (0.5405 * 0.25) + (0.3243 * 0.25) + (0.1351 * 8) = 0.1351 + 0.0811 + 1.081 = 1.297

* Therefore, the weighted average modified duration is approximately 1.30.

References Calculation based on standard formula and weights derived from the table.

* The modified duration of the portfolio is a weighted average of the durations of the individual bonds, where the weights are the proportions of the total portfolio value.

* Calculate the total value of the portfolio: $200 MM (3-year floater) + $120 MM (5-year floater) +

$50 MM (10-year fixed) = $370 MM.

* Calculate the weights for each bond:

* 3-year floater: $200 MM / $370 MM = 0.5405

* 5-year floater: $120 MM / $370 MM = 0.3243

* 10-year fixed: $50 MM / $370 MM = 0.1351

* Multiply each bond's weight by its modified duration and sum the results:

* (0.5405 * 0.25) + (0.3243 * 0.25) + (0.1351 * 8) = 0.1351 + 0.0811 + 1.081 = 1.297

* Therefore, the weighted average modified duration is approximately 1.30.

References Calculation based on standard formula and weights derived from the table.

- Question List (145q)

- Question 1: Which of the following are the most common methods to increa...

- Question 2: Which one of the four following statements about technology ...

- Question 3: Which one of the following four statements correctly describ...

- Question 4: Short-selling is typically associated with the following ris...

- Question 5: When looking at the distribution of portfolio credit losses,...

- Question 6: The market risk manager of SigmaBank is concerned with the v...

- Question 7: A bank customer expecting to pay its Brazilian supplier BRL ...

- Question 8: Which statements correctly describe the features of using su...

- Question 9: Bank G has a 1-year VaR of USD 20 million at 99% confidence ...

- Question 10: According to Basel II what constitutes Tier 2 capital?...

- Question 11: Which of the following measure describes the symmetry of a s...

- Question 12: A risk associate responsible for the operational risk functi...

- Question 13: Which one of the following four statements about equity indi...

- Question 14: Alpha Bank determined that Delta Industrial Machinery Corpor...

- Question 15: Altman's Z-score incorporates all the following variables th...

- Question 16: Mega Bank holds a $250 million mortgage loan portfolio, whic...

- Question 17: From the bank's point of view, repricing the retail debt por...

- Question 18: What is the role of market risk management function within a...

- Question 19: Which one of the following four statements presents a challe...

- Question 20: The exercise for an American type option prior to expiration...

- Question 21: In additional to the commodity-specific risks, which of the ...

- Question 22: Which of the following statements are reasons for mathematic...

- Question 23: Banks duration match their assets and liabilities to manage ...

- Question 24: In its VaR calculations, JPMorgan Chase uses an expected tai...

- Question 25: Which of the following statements regarding CDO-squared is c...

- Question 26: Which one of the following statements about futures contract...

- Question 27: Which of the following statements about the option gamma is ...

- Question 28: Gamma Bank is active in loan underwriting and securitization...

- Question 29: To manage its credit portfolio, Beta Bank can directly sell ...

- Question 30: To protect the oranges harvest price level, a farmer needs t...

- Question 31: For two variables, which of the following is equal to the av...

- Question 32: Which one of the following four statements regarding commodi...

- Question 33: A credit portfolio manager analyzes a large retail credit po...

- Question 34: Most loans and deposits in the interbank market have a matur...

- Question 35: Which one of the following four statements regarding counter...

- Question 36: To improve the culture and awareness of the operational risk...

- Question 37: Except for the credit quality of the Credit Default Swap pro...

- Question 38: Which one of the following four alternatives correctly ident...

- Question 39: James Johnson has a $1 million long position in ThetaGroup w...

- Question 40: Which one of the following four statements on factors affect...

- Question 41: A risk associate evaluating his current portfolio of assets ...

- Question 42: Which one of the following four statements about the "market...

- Question 43: Which of the following assets on the bank's balance sheet ha...

- Question 44: Securitization is the process by which banks I. Issue bonds ...

- Question 45: What are some of the drawbacks of correlation estimates? Whi...

- Question 46: What are the add-on losses faced by a bank that is going ban...

- Question 47: A key function of treasuries in commercial/retail banks is: ...

- Question 48: A financial analyst is trying to distinguish credit risk fro...

- Question 49: A bank customer expecting to pay its Brazilian supplier BRL ...

- Question 50: Which one of the following four statements correctly defines...

- Question 51: Floating rate bonds typically have ________ duration which m...

- Question 52: DeltaFin wants to develop a control scoring method for its R...

- Question 53: Which one of the following four regulatory drivers for opera...

- Question 54: A credit risk analyst is evaluating factors that quantify cr...

- Question 55: Which one of the following four statements about hedging is ...

- Question 56: A corporate bond was trading with 2%probability of default a...

- Question 57: Bank Zilo has $2 million in cash and $10 million in loans co...

- Question 58: What is the order in which creditors and shareholders get re...

- Question 59: Interest rate swaps are:

- Question 60: A portfolio consists of two floating rate bonds and one fixe...

- Question 61: An associate from the finance group has been identified as a...

- Question 62: Which one of the following four alternatives lists the three...

- Question 63: Gamma Bank has $300 million in loans and $200 million in dep...

- Question 64: If a bank is long £500 million pounds, short £300 million in...

- Question 65: Banks duration match their assets and liabilities to manage ...

- Question 66: Which one of the following four exotic option types has anot...

- Question 67: As Japan ___ its budget deficits and ___ its dependence on d...

- Question 68: In the United States, foreign exchange derivative transactio...

- Question 69: To estimate a partial change in option price, a risk manager...

- Question 70: According to the largest global poll of foreign exchange mar...

- Question 71: Asset and liability management is typically concerned with a...

- Question 72: A credit analyst wants to determine if her bank is taking to...

- Question 73: Which of the following attributes of duration gap model typi...

- Question 74: Gamma Bank provides a $100,000 loan to Big Bath retail store...

- Question 75: To hedge equity exposure without buying or selling shares of...

- Question 76: Which of the following reports have been suggested by the FD...

- Question 77: Returns on two assets show very strong positive linear relat...

- Question 78: What is a common implicit assumption that is made when compu...

- Question 79: Modified duration of a bond measures:...

- Question 80: The operational risk policy should include: I. The firm's de...

- Question 81: To estimate the price of gold forwards, an investment analys...

- Question 82: By lowering the spread on lower credit quality borrowers, th...

- Question 83: Which of the activities represent examples of market manipul...

- Question 84: Which of the following statements regarding bonds is correct...

- Question 85: Which one of the following statements correctly identifies r...

- Question 86: Which of the following statements presents an advantage of u...

- Question 87: A corporate bond gives a yield of 6%. A same maturity govern...

- Question 88: Which among the following are shortfalls of the static liqui...

- Question 89: Which of the following are conclusions that could be drawn f...

- Question 90: Why do regulatory standards impose formulaic capital calcula...

- Question 91: A large energy company has a recurring foreign currency dema...

- Question 92: Beta Insurance Company is only allowed to invest in investme...

- Question 93: Which one of the following four attributes would likely help...

- Question 94: Which one of the following statements is an advantage of usi...

- Question 95: Alpha Bank estimates its 1-month, 95% VaR is 30 million EUR....

- Question 96: Jack Richardson wants to compute the 1-month VaR of a portfo...

- Question 97: Which of the following statements about endogenous and exoge...

- Question 98: Which one of the four following statements about Basis point...

- Question 99: Which one of the four following statements about drawdowns i...

- Question 100: Which one of the following four statements best describes ch...

- Question 101: A bank customer chooses a mortgage with low initial payments...

- Question 102: Which one of the following four statements about regulatory ...

- Question 103: Which one of the following statements describes Macauley's d...

- Question 104: When considering the advantages of operational risk function...

- Question 105: Gamma Bank has a significant number of retail customers and ...

- Question 106: The value of which one of the following four option types is...

- Question 107: An asset and liability manager for a large financial institu...

- Question 108: Which one of the four following activities is NOT a componen...

- Question 109: A bank owns a portfolio of bonds whose composition is shown ...

- Question 110: Which of the following statements about the interest rates a...

- Question 111: Which one of the following four statements correctly defines...

- Question 112: In the United States, during the second quarter of 2009, tra...

- Question 113: Arnold Wu owns a floating rate bond. He is concerned that th...

- Question 114: Bank Milo has $4 million in cash and $5 million in loans com...

- Question 115: To reduce the variability of net interest income, Gamma Bank...

- Question 116: After entering the securitization business, Delta Bank incre...

- Question 117: Bank Alpha is making a decision about lending 10-year loans ...

- Question 118: A bank customer expecting to pay its Brazilian supplier BRL ...

- Question 119: Which one of the following four statements about economic ca...

- Question 120: To estimate the forward price of oil, a commodity trader wou...

- Question 121: ThetaBank has extended substantial financing to two mortgage...

- Question 122: An endowment asset manager with a focus on long/short equity...

- Question 123: In early March, an energy trader takes a long position in na...

- Question 124: US-based BetaBank have accumulated Japanese yen, Japanese go...

- Question 125: Which of the following factors would typically increase the ...

- Question 126: A risk analyst is considering how to reduce the bank's expos...

- Question 127: Which of the following statements explain how securitization...

- Question 128: A customer asks a broker employed by AlphaBank to buy Eureka...

- Question 129: The skewness of ABC company's stock returns equal -1.5. What...

- Question 130: Over a long period of time DeltaBank has amassed a large equ...

- Question 131: Which one of the following is a reason for a bank to keep a ...

- Question 132: Which of the following bank events could stress the bank's l...

- Question 133: A bank has a Var estimate of $100 million. It is considering...

- Question 134: Which one of the four following statements regarding minimum...

- Question 135: Which of the following would a bank resort to as a "lender o...

- Question 136: Which one of the four following statements describes a speci...

- Question 137: To hedge a foreign exchange exposure on behalf of a client, ...

- Question 138: Which of the following are typical properties of a statistic...

- Question 139: To estimate the responsiveness of a particular equity portfo...

- Question 140: Which one of the following four factors typically drives the...

- Question 141: To estimate the interest charges on the loan, an analyst sho...

- Question 142: After entering the securitization business, Delta Bank incre...

- Question 143: Gamma Bank provides a $100,000 loan to Big Bath retail store...

- Question 144: BetaFin has decided to use the hybrid RCSA approach because ...

- Question 145: Which one of the following four models is typically used to ...