- Home

- IFSE Institute

- Canadian Investment Funds Course Exam

- IFSEInstitute.CIFC.v2024-01-19.q72

- Question 14

Valid CIFC Dumps shared by ExamDiscuss.com for Helping Passing CIFC Exam! ExamDiscuss.com now offer the newest CIFC exam dumps, the ExamDiscuss.com CIFC exam questions have been updated and answers have been corrected get the newest ExamDiscuss.com CIFC dumps with Test Engine here:

Access CIFC Dumps Premium Version

(225 Q&As Dumps, 35%OFF Special Discount Code: freecram)

<< Prev Question Next Question >>

Question 14/72

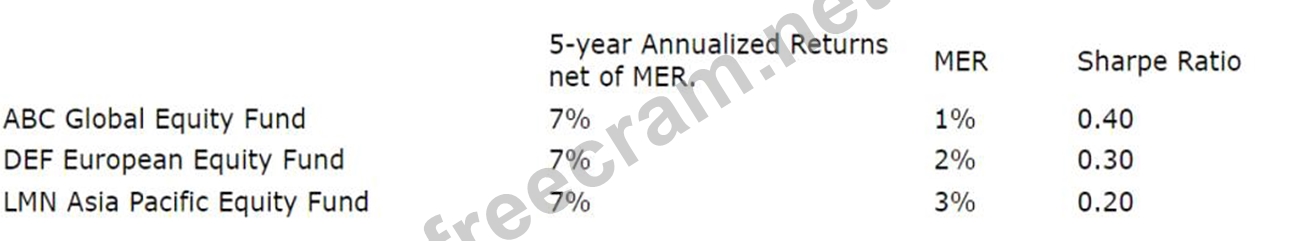

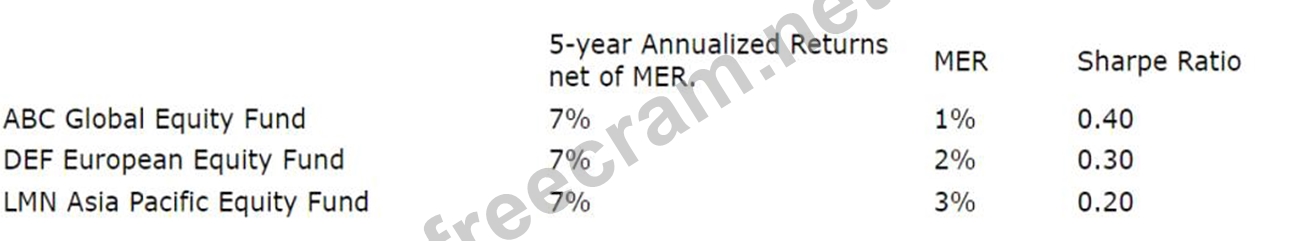

Danny is a Dealing Representative for Everbright Investments. He met with his client Adele, who has

$1,000,000 to invest. During their meeting Danny determines that Adele has a high-risk profile. In addition, he learns that she has an excellent understanding of equities and how volatile they can be. Danny is considering recommending growth funds specifically, and making a recommendation from the following investment options:

Based on the information provided, which mutual fund should Danny recommend?

$1,000,000 to invest. During their meeting Danny determines that Adele has a high-risk profile. In addition, he learns that she has an excellent understanding of equities and how volatile they can be. Danny is considering recommending growth funds specifically, and making a recommendation from the following investment options:

Based on the information provided, which mutual fund should Danny recommend?

Correct Answer: D

Explanation

Adele has a high-risk profile and an excellent understanding of equities. Therefore, it would be appropriate for Danny to recommend growth funds. However, since Adele has $1,000,000 to invest, it would be prudent to diversify her investments and invest equally in all 3 funds. This way, she can benefit from the exposure to different regions and sectors, and reduce the impact of market fluctuations on her portfolio. Based on the table, all 3 funds have the same 5-year annualized returns net of MER, which is 15%. However, they have different MERs and Sharpe ratios. The MER is the fee charged by the fund manager for managing the fund, and the Sharpe ratio is a measure of risk-adjusted return. A lower MER means a lower cost for the investor, and a higher Sharpe ratio means a higher return per unit of risk. Therefore, investing equally in all 3 funds would allow Adele to achieve a balanced trade-off between cost and performance. References:

Canadian Investment Funds Course (CIFC) Study Guide, Chapter 4: Mutual Funds, Section 4.2: Types of Mutual Funds, page 4-6 Canadian Investment Funds Course (CIFC) Study Guide, Chapter 5: Fixed-Income Securities, Section

5.5: Risk-Return Trade-Offs, page 5-14

Sharpe Ratio Definition - Investopedia

Adele has a high-risk profile and an excellent understanding of equities. Therefore, it would be appropriate for Danny to recommend growth funds. However, since Adele has $1,000,000 to invest, it would be prudent to diversify her investments and invest equally in all 3 funds. This way, she can benefit from the exposure to different regions and sectors, and reduce the impact of market fluctuations on her portfolio. Based on the table, all 3 funds have the same 5-year annualized returns net of MER, which is 15%. However, they have different MERs and Sharpe ratios. The MER is the fee charged by the fund manager for managing the fund, and the Sharpe ratio is a measure of risk-adjusted return. A lower MER means a lower cost for the investor, and a higher Sharpe ratio means a higher return per unit of risk. Therefore, investing equally in all 3 funds would allow Adele to achieve a balanced trade-off between cost and performance. References:

Canadian Investment Funds Course (CIFC) Study Guide, Chapter 4: Mutual Funds, Section 4.2: Types of Mutual Funds, page 4-6 Canadian Investment Funds Course (CIFC) Study Guide, Chapter 5: Fixed-Income Securities, Section

5.5: Risk-Return Trade-Offs, page 5-14

Sharpe Ratio Definition - Investopedia

- Question List (72q)

- Question 1: While assessing the suitability of an investment recommendat...

- Question 2: Gregory is a conservative investor who wants to hold a portf...

- Question 3: Malik has been saving money for retirement but he is worried...

- Question 4: On January 3, John invests $500 in the Blue Sky U.S. Equity ...

- Question 5: Thomas, a resident of Ontario, is a full-time university stu...

- Question 6: When comparing mutual funds, what information would help a D...

- Question 7: Which of the following Dealing Representatives has CORRECTLY...

- Question 8: Which of the following Dealing Representatives has fulfilled...

- Question 9: The Mutual Fund Dealers Association of Canada (MFDA) has str...

- Question 10: Over the course of a couple of weeks and several appointment...

- Question 11: Which of the following statement about Exchange Traded Funds...

- Question 12: What do Guaranteed Income Supplement (GIS) and Allowance for...

- Question 13: Maalik opens an account for a new client, John. During the n...

- Question 14: Danny is a Dealing Representative for Everbright Investments...

- Question 15: Stan, a portfolio manager, is looking at two steel companies...

- Question 16: Which of the following statements is TRUE about the movement...

- Question 17: Quintin has been a Dealing Representative for Global Maximum...

- Question 18: Dakota is a Dealing Representative with Harvest Wealth Inc.,...

- Question 19: Pippa purchased a 15-year bond with a face value of $5,000 a...

- Question 20: Your client, Rinaldo, wants to know more about the fees asso...

- Question 21: Sujay contributes 3% of his $60,000 salary to his employer's...

- Question 22: What information does Fund Facts provide to potential invest...

- Question 23: Louis is the portfolio manager for Quattro Fund. The mandate...

- Question 24: You have been researching Canadian equity mutual funds for a...

- Question 25: Jehona is a Dealing Representative with Vista Wealth Investm...

- Question 26: Michael had invested in several mutual funds, most of which ...

- Question 27: Xerxes, 45 years old, is a successful architect, having an a...

- Question 28: Which of the following statements are CORRECT about labour s...

- Question 29: Ellen and her only son Jeff live on the family farm with her...

- Question 30: Your client Charlie is thinking about making a large investm...

- Question 31: Your clients, Jessica and Ken, want to buy a house next year...

- Question 32: Jonathan is a Dealing Representative who has just finished a...

- Question 33: Which of the following statements about your mutual fund reg...

- Question 34: Which statement about unused registered retirement savings p...

- Question 35: Last year Peter's earned income from employment was $50,000....

- Question 36: Marta is turning 71 years old this year. She will have to co...

- Question 37: One of your clients, Harry, has heard that he can defer payi...

- Question 38: Your client, Cosmo, recently inherited $50,000 from his uncl...

- Question 39: Which of the following is a conflict of interest that should...

- Question 40: Lucas wants to participate in the Lifelong Learning Program ...

- Question 41: With respect to the tax treatment of dividends received from...

- Question 42: Karen's know your client (KYC) profile corresponds to someon...

- Question 43: Frederic recently sold his units in a US dollar (USD) denomi...

- Question 44: When you buy a put option, which of the following is TRUE?...

- Question 45: Quinton, a Dealing Representative, meets with his client Ban...

- Question 46: Sylvia decided to use the savings from her bank account to p...

- Question 47: Which of the following qualifies as personal information und...

- Question 48: Sean purchases 500 units of Penn Canadian Equity Fund when t...

- Question 49: Which of the followings describes segregated funds?...

- Question 50: Which of the following is included when calculating a countr...

- Question 51: In which of the following situations would the client mobili...

- Question 52: Your client, Kimberly has investments in both registered and...

- Question 53: Which among the following BEST describes a company's income ...

- Question 54: Portia is a Dealing Representative with Highview Wealth Inc....

- Question 55: Khuyen is a Dealing Representative for Stark Contrast Invest...

- Question 56: Jabir recently joined Prosper Wealth Inc. and is looking for...

- Question 57: Which statement about a net capital loss incurred by a mutua...

- Question 58: Justin and Yvonne both open a Registered Education Savings P...

- Question 59: You are meeting a potential client, William, for the first t...

- Question 60: Daisy is a Dealing Representative registered in the province...

- Question 61: Eleanora receives a $500 eligible Canadian dividend from her...

- Question 62: Your employer has a contributory group RRSP under which he m...

- Question 63: Janine will celebrate her 71st birthday this year. She curre...

- Question 64: Which of the following statements best describes dollar-cost...

- Question 65: Which of the following CORRECTLY describes a material confli...

- Question 66: Which of the following is a characteristic of a bond fund?...

- Question 67: In a mutual fund dealer, who is the person responsible for e...

- Question 68: Jasmine received an inheritance from her grandmother of $10,...

- Question 69: Last year at age 70, Gregory opened a registered retirement ...

- Question 70: One of your clients, Rakesh, had a portfolio composed of 60%...

- Question 71: Xerxes, 45 years old, is a successful architect, having an a...

- Question 72: Throughout the year, the Redwood Global Equity Fund generate...