- Home

- Microsoft

- Microsoft Dynamics 365: Finance and Operations Apps Solution Architect

- Microsoft.MB-700.v2025-05-08.q135

- Question 81

Valid MB-700 Dumps shared by ExamDiscuss.com for Helping Passing MB-700 Exam! ExamDiscuss.com now offer the newest MB-700 exam dumps, the ExamDiscuss.com MB-700 exam questions have been updated and answers have been corrected get the newest ExamDiscuss.com MB-700 dumps with Test Engine here:

Access MB-700 Dumps Premium Version

(326 Q&As Dumps, 35%OFF Special Discount Code: freecram)

<< Prev Question Next Question >>

Question 81/135

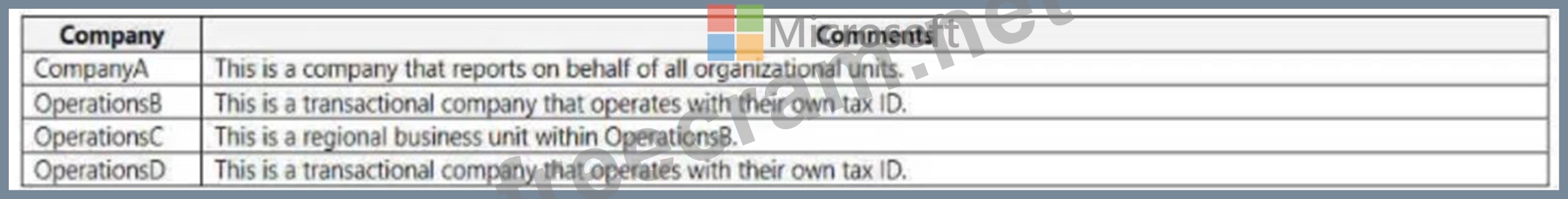

A professional services company is implementing Dynamics 365 Finance. The company has the following business entities:

You need to configure the system to support this organizational structure.

How should you configure the organization? To answer, drag the appropriate configurations to the correct entities. Each configuration may be used once. more than once. or not at all You may need to drag the split bar between panes or scroll to view content.

NOTE: Each correct selection is worth one point.

You need to configure the system to support this organizational structure.

How should you configure the organization? To answer, drag the appropriate configurations to the correct entities. Each configuration may be used once. more than once. or not at all You may need to drag the split bar between panes or scroll to view content.

NOTE: Each correct selection is worth one point.

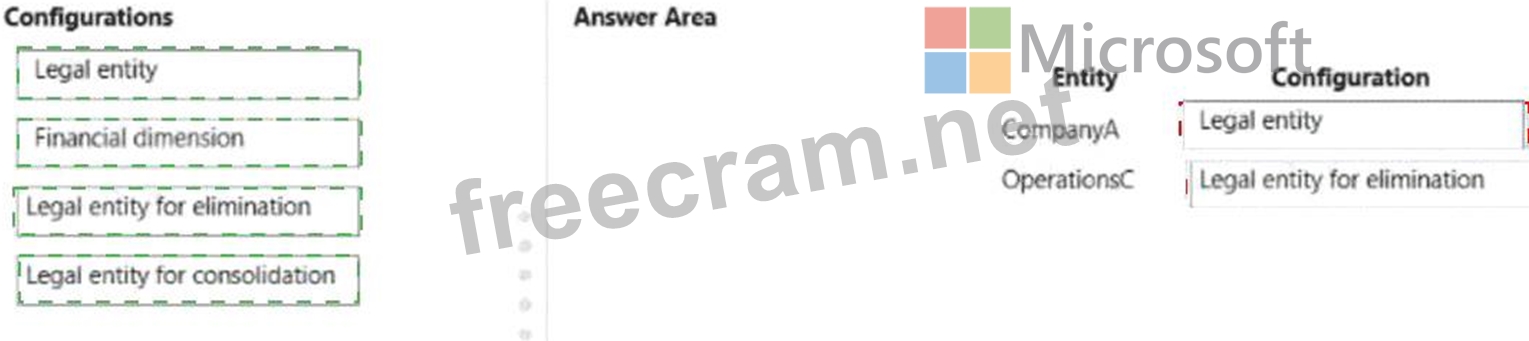

Correct Answer:

Explanation:

Box 1: Legal entity

Box 2: Legal entity for elimination

Elimination transactions are required when a parent legal entity does business with one or more subsidiary legal entities and uses consolidated financial reporting. Consolidated financial statements must include only transactions that occur between the consolidated organization and other entities outside that organizations.

Therefore, transactions between legal entities that are part of the same organization must be removed, or eliminated, from the general ledger, so they don't appear on financial reports. There are multiple ways to report about eliminations:

An elimination rule can be created and processed in a consolidation or elimination company.

Financial reporting can be used to show the eliminations accounts and dimensions on a specific row or column.

A separate legal entity can be used to post manual transaction entries to track eliminations.

Reference: https://docs.microsoft.com/en-us/dynamics365/finance/general-ledger/elimination-rules

- Question List (135q)

- Question 1: A company with multiple legal entities implements Dynamics 3...

- Question 2: You need to define Margie's Travel legal entity and tenant s...

- Question 3: A graphic design school is implementing ERP by using Dynamic...

- Question 4: A company is implementing Dynamics 365 Finance. The company ...

- Question 5: A company uses Dynamics 365 Supply Chain Management. The com...

- Question 6: A company that rents photocopiers is implementing Dynamics 3...

- Question 7: Note: This question is part of a series of questions that pr...

- Question 8: A company implements Dynamics 365 Supply Chain Management fo...

- Question 9: A company uses Dynamics 365 Finance. The company receives a ...

- Question 10: Fourth Coffee plans to implement Dynamics 365 Finance and Dy...

- Question 11: A company is implementing Dynamics 365 Supply Chain Manageme...

- Question 12: A company is evaluating licensing for Dynamics 365 Finance. ...

- Question 13: Note: This question is part of a series of questions that pr...

- Question 14: A company plans to implement Dynamics 365 Supply Chain Manag...

- Question 15: A company uses Dynamics 365 Finance and Dynamics 365 Supply ...

- Question 16: A company plans to implement Dynamics 365 Supply Chain Manag...

- Question 17: You are a solution architect at a company that uses Dynamics...

- Question 18: Your company has a Microsoft has a Microsoft 365 subscriptio...

- Question 19: You need to determine the licensing components for Objective...

- Question 20: A utility company has the financial users. Two of the users ...

- Question 21: A distribution company uses Dynamics 365 Supply Chain Manage...

- Question 22: A customer is implementing Dynamics 365 Finance and Dynamics...

- Question 23: A company plans to use Dynamics 365 finance and operations a...

- Question 24: A company plans its Dynamics 365 finance and operations apps...

- Question 25: A company uses AX 2012 R3 and plans 10 migrate to Dynamics 3...

- Question 26: A company is implementing Dynamics 365 Supply Chain Manageme...

- Question 27: You need to determine which tool to use to run the vendor's ...

- Question 28: A company plans to implement Dynamics 365 Finance and purcha...

- Question 29: A company plans to implement Dynamics 365 Finance. The compa...

- Question 30: A toy manufacturer keeps finished products in a physical war...

- Question 31: A company is planning a Dynamics 365 Supply Chain Management...

- Question 32: You need to create a plan that meets the following requireme...

- Question 33: Your company has a Microsoft has a Microsoft 365 subscriptio...

- Question 34: A company is implementing Dynamics 365 Finance. The company ...

- Question 35: A company uses Dynamics 365 Finance and Supply Chain Managem...

- Question 36: A company is implementing Dynamics 365 Finance. The company ...

- Question 37: A midsize company is enrolled in the self-guided FastTrack p...

- Question 38: You need to determine which system functionality meets the b...

- Question 39: Note: This question is part of a series of questions that pr...

- Question 40: Note: This question is part of a series of questions that pr...

- Question 41: A company is using Dynamics 365 Finance. You need to ensure ...

- Question 42: You need to manage the roles and responsibilities tor securi...

- Question 43: You need to implement the planned changes for the marketing ...

- Question 44: A company is planning a Dynamics 365 deployment. The company...

- Question 45: A company uses Dynamics 365 Finance. Which environment or en...

- Question 46: You need to recommend a solution tor tracking business proce...

- Question 47: Note: This question is part of a series of questions that pr...

- Question 48: You need to implement the planned changes for the marketing ...

- Question 49: You need to recommend a purchasing process based on the requ...

- Question 50: A research institute is implementing Dynamics 365 Finance an...

- Question 51: A company audits the security of its Dynamics 365 Supply Cha...

- Question 52: A company is implementing Dynamics 365 Finance. The company ...

- Question 53: A distribution center uses Dynamics 365 Supply Chain Managem...

- Question 54: A customer is implementing Dynamics 365 Supply Chain Managem...

- Question 55: You need to recommend Microsoft solutions for City Power and...

- Question 56: You must recommend a solution to meet the requirements for U...

- Question 57: An organization uses Dynamics 365 Finance and Dynamics 365 S...

- Question 58: A company is deploying a Microsoft Power Platform solution. ...

- Question 59: A food production company is implementing Dynamics 365 Suppl...

- Question 60: You need to select the code package for the loyalty program....

- Question 61: Note: This question is part of a series of questions that pr...

- Question 62: A company plans to implement Dynamics 365 Finance and Supply...

- Question 63: A company implements Dynamics 365 Commerce. The company has ...

- Question 64: You need to configure a policy for the IR department to meet...

- Question 65: You need to recommend a tool to meet the solution requiremen...

- Question 66: A company plans an implementation of Dynamics 365 Finance an...

- Question 67: An organization is implementing Dynamics 365 Finance. You ne...

- Question 68: You need to recommend a solution for the business process te...

- Question 69: A manufacturing company uses Dynamics AX 2012 R3 for high-vo...

- Question 70: A company implements a Microsoft Power Platform solution The...

- Question 71: You need to recommend a site and warehouse configuration. Wh...

- Question 72: A company is implementing Dynamics 365 Finance. The company ...

- Question 73: A company is determining which reporting tools to use as par...

- Question 74: Note: This question is part of a series of questions that pr...

- Question 75: Which license should you purchase to meet the technical requ...

- Question 76: A company is implementing Dynamics 365 Finance. The company ...

- Question 77: A company is implementing Dynamics 365 Finance. The company ...

- Question 78: A customer deploys Dynamics 365 Customer Service. The custom...

- Question 79: A company uses the vendor collaboration functionality within...

- Question 80: A client plans to implement Dynamics 365 Finance. The client...

- Question 81: A professional services company is implementing Dynamics 365...

- Question 82: A company uses Dynamics 365 Supply Chain Management. A user ...

- Question 83: A travel agency is implementing Dynamics 365 Finance and Dyn...

- Question 84: A Dynamics 365 user is enrolled in the FastTrack program. Th...

- Question 85: You need to recommend a solution to send notifications to cl...

- Question 86: A company plans to use Dynamics 365 Finance. You are prepari...

- Question 87: Note: This question is part of a series of questions that pr...

- Question 88: A company plans to build Power Apps apps as part of their di...

- Question 89: You need to determine which development environments to depl...

- Question 90: You need to recommend solutions to streamline the business p...

- Question 91: A company with multiple legal entities implements Dynamics 3...

- Question 92: You need to determine a solution for the customers in Jamaic...

- Question 93: A trading company is concerned about the impact of General D...

- Question 94: The company uses Lifecycle Services (LCS) environment monito...

- Question 95: A company is implementing Dynamics 365 Supply Chain Manageme...

- Question 96: Company policy restricts employees from filling expense repo...

- Question 97: A customer implements Dynamics 365 Finance and Dynamics 365 ...

- Question 98: You are an architect implementing a Dynamics 365 Finance env...

- Question 99: A local community college uses Microsoft SharePoint Online t...

- Question 100: A company implements Dynamics 365 Finance in a self-service ...

- Question 101: A company plans to use Dynamics 365 Finance. The company has...

- Question 102: A professional services company plans to implement Dynamics ...

- Question 103: A company is planning a Dynamics 365 Supply Chain Management...

- Question 104: A company is implementing a new Dynamics 365 cloud deploymen...

- Question 105: A telecom provider uses Microsoft SharePoint to track and ma...

- Question 106: You need to recommend solutions to meet the ClO's requiremen...

- Question 107: A company is using Dynamics 365 Finance. You need to ensure ...

- Question 108: A company plans its disaster recovery strategy for Dynamics ...

- Question 109: A company is implementing Dynamics 365 Finance. A series of ...

- Question 110: A company is implementing Dynamics 365 Finance. The company ...

- Question 111: You need to recommend how to resolve audit compliance findin...

- Question 112: An organization is implementing Dynamics 365 Finance. The or...

- Question 113: A company is planning to implement Dynamics 365 Finance and ...

- Question 114: You need to solve User1's issue. What should you create?...

- Question 115: A client wants to create a custom view-only security role th...

- Question 116: A company implements Dynamics 365 Finance. The company needs...

- Question 117: You need to solve User1's issue. What should you create?...

- Question 118: You need to recommend a strategy to resolve the issue with t...

- Question 119: An organization is planning to migrate to Dynamics 365 Finan...

- Question 120: A company uses Dynamics 365 Finance. The company wants to un...

- Question 121: You need to recommend a solution to meet Margie's consolidat...

- Question 122: Note: This question is part of a series of questions that pr...

- Question 123: A company is planning a Dynamics 365 Finance implementation ...

- Question 124: A company uses out-of-the-box functionality in Dynamics 365 ...

- Question 125: A company uses Dynamics 365 finance and operations apps. The...

- Question 126: A company uses Dynamics 365 finance and operations apps. The...

- Question 127: Note: This question is part of a series of questions that pr...

- Question 128: Note: This question is part of a series of questions that pr...

- Question 129: Your company has a Microsoft has a Microsoft 365 subscriptio...

- Question 130: You need to define the loyalty process gap. What should you ...

- Question 131: A manufacturing company has multiple factories and distribut...

- Question 132: An organization is planning a new Dynamics 365 Finance + Ope...

- Question 133: You are planning a Dynamics 365 implementation. You need to ...

- Question 134: A customer is planning to migrate to Dynamics 365 Finance. Y...

- Question 135: You are a consultant for Proseware, Inc. You need to audit t...