Valid L4M7 Dumps shared by ExamDiscuss.com for Helping Passing L4M7 Exam! ExamDiscuss.com now offer the newest L4M7 exam dumps, the ExamDiscuss.com L4M7 exam questions have been updated and answers have been corrected get the newest ExamDiscuss.com L4M7 dumps with Test Engine here:

Access L4M7 Dumps Premium Version

(297 Q&As Dumps, 35%OFF Special Discount Code: freecram)

<< Prev Question Next Question >>

Question 38/121

Assuming that all other factors are constant except one, the net present value of a capital expendi-ture increases when...?

Correct Answer: C

Net present value (NPV) is the 'today' net value that deprives from 'future' cash flow of an invest-ment or a capital purchase.

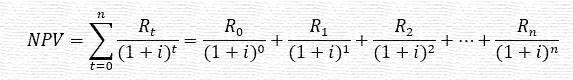

The following formula is used to calculate NPV

Chart Description automatically generated with low confidence

Where:

Rt is the net cash flow (cash inflow - cash outflow) during the period t i is the discount rate t is the number of time periods As you can conclude from the above formula, the net present value increases when the numerators (net cash flows) increase and/or denominators (1+i) decrease. So the correct answer should be "Net cash flow during a time period increases" The purpose of this exercise is to help you identify the factors that influence the net present value and how to increase/decrease NPV in real-world scenario.

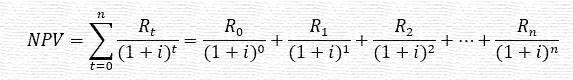

The following formula is used to calculate NPV

Chart Description automatically generated with low confidence

Where:

Rt is the net cash flow (cash inflow - cash outflow) during the period t i is the discount rate t is the number of time periods As you can conclude from the above formula, the net present value increases when the numerators (net cash flows) increase and/or denominators (1+i) decrease. So the correct answer should be "Net cash flow during a time period increases" The purpose of this exercise is to help you identify the factors that influence the net present value and how to increase/decrease NPV in real-world scenario.

- Question List (121q)

- Question 1: Buffer stock is a level of stock which......

- Question 2: Warehouse automation involves the use of technology to perfo...

- Question 3: Which of the following would be an impact of low stock in th...

- Question 4: Hi-Tech Products Inc. (HTP) has just opened a new state-of-t...

- Question 5: RFID uses radio frequencies for the purpose of identificatio...

- Question 6: Which of the following is often created by each business and...

- Question 7: The size of order that minimises the total cost of acquiring...

- Question 8: A warehouse manager is evaluating the use of Automated Guide...

- Question 9: A cardiac department within a local hospital carries out a s...

- Question 10: The amount of inventory available at the start of an account...

- Question 11: A procurement manager (PM) is purchasing a piece of capital ...

- Question 12: Company XYZ is a candy manufacturer. Company XYZ makes a bat...

- Question 13: Which of the following is an assumption of economic-order-qu...

- Question 14: Which type of codes can a barcode laser scanner (linear scan...

- Question 15: The minimal total cost is always achieved when there is only...

- Question 16: Which of the following is the most suitable container of fas...

- Question 17: A manufacturing organisation has a large volume of raw mater...

- Question 18: Stockyards are suitable for specific materials with which of...

- Question 19: Which of the following is another name for scheduled (routin...

- Question 20: A procurement manager has agreed a contract for the acquisit...

- Question 21: The size of the order that minimizes the total cost of acqui...

- Question 22: Which of the following are examples of subjective methods of...

- Question 23: Is it correct to state that the accuracy of demand forecasts...

- Question 24: RFID uses radio frequencies for the purpose of identificatio...

- Question 25: A company does not have enough space to hold inventory to sa...

- Question 26: XYZ Ltd is a major distributor of electrical equipment prote...

- Question 27: A manufacturer has discovered that some of the stock in its ...

- Question 28: The width of aisles within a warehouse is determined by...?...

- Question 29: Holding inventory is key to ensure that an organisation can ...

- Question 30: A hospital is purchasing a new software product that will ad...

- Question 31: Bulk loose coal that requires massive handling system should...

- Question 32: Which of the following are most likely to be direct benefits...

- Question 33: Practice of unloading goods from inbound delivery vehicles a...

- Question 34: Decommissioning, removal and disposal of assets may have imp...

- Question 35: "Open stock plus purchases minus closing stock" is the formu...

- Question 36: Which of the following are likely to be included in a formal...

- Question 37: What are the contents of master production schedule in MRP s...

- Question 38: Assuming that all other factors are constant except one, the...

- Question 39: GAP Ltd is a growing retail business. It spends a lot of mon...

- Question 40: What is the stock turn for a store holding products to the v...

- Question 41: ANTA Logistics is looking for a place to build a new, integr...

- Question 42: A supplier delivers large quantities of inventory to its cus...

- Question 43: The time period between placing an order and its receipt in ...

- Question 44: Which of the following are main objectives of warehouse oper...

- Question 45: Staff at DIY Products Inc. (DPI) have been experiencing issu...

- Question 46: Which of the following costs may be considered part of the h...

- Question 47: Which of the following is a benefit of bar code scanning sys...

- Question 48: Which of the following are advantages of a multi-story wareh...

- Question 49: A procurement manager is sourcing some high-value equipment ...

- Question 50: Which of the following are advantages for a purchasing organ...

- Question 51: An organisation might find it more beneficial to lease and u...

- Question 52: Which of the following costs can be classified as 'acquisiti...

- Question 53: Which of the following factors should be considered in the c...

- Question 54: Which of the following are warehouse layouts that allow the ...

- Question 55: Amanda is the purchasing manager for AB Construction based i...

- Question 56: Do all types of warehouses require access to daylight to red...

- Question 57: MRP system is the most suitable IT system to manage which ty...

- Question 58: XYZ Ltd is a large retailer who offers a range of products w...

- Question 59: Which of the following is another name for scheduled (routin...

- Question 60: A brewery sells its beer in aluminum cans. It recycles the c...

- Question 61: Which ONE of the following correctly differentiates between ...

- Question 62: Why do you need a life cycle asset management plan?...

- Question 63: Which of the following materials handling equipment can be u...

- Question 64: A logistics company has a 2-story warehouse in the suburban ...

- Question 65: Your company has established the number of new warehouses it...

- Question 66: Which of the following would be an impact of low stock in th...

- Question 67: Which of the following lists all components, ingredients, an...

- Question 68: An organisation always obtains negative cash flow regarding ...

- Question 69: Zemora Clothing Inc. receives high-priced garments with devi...

- Question 70: Which of the following are typical characteristics of 2D bar...

- Question 71: Which of the following statements holds true about inventory...

- Question 72: An organisation may incur additional costs in stockout event...

- Question 73: Which of the following is a forecasting technique?...

- Question 74: Inventory may be classified into direct and indirect supplie...

- Question 75: What is meant by the economic life of an asset?...

- Question 76: In a manufacturing facility, which types of inventory have t...

- Question 77: In inventory management, the cost of insurance and taxes are...

- Question 78: Which of the following correctly describes the triple bottom...

- Question 79: What is meant by the term 'obsolete stock'?...

- Question 80: Nuclear Energy Group Limited (NEG) has a number of investmen...

- Question 81: Multiple approval levels for a small purchase request is an ...

- Question 82: A construction organization requires specialist equipment fo...

- Question 83: Which of the following are holding costs? Select THREE that ...

- Question 84: A group of items which are stacked together for more conveni...

- Question 85: Which of the following best describe the function of MRP?...

- Question 86: International Standard Book Number (ISBN) is a unique intern...

- Question 87: Which of the following are examples of subjective methods of...

- Question 88: A meaning of 'decommissioning a piece of equipment' is to......

- Question 89: Which of the following are the different types of inventory ...

- Question 90: Which of the following would be considered independent deman...

- Question 91: Which of the following statements about radio frequency iden...

- Question 92: A procurement manager has been asked to justify the purchase...

- Question 93: Which of the following are holding costs of inventory in a w...

- Question 94: An electricity company charges its customers monthly fee for...

- Question 95: A central distribution warehouse receives deliveries from se...

- Question 96: A manufacturer has discovered that some of the stock in its ...

- Question 97: A manufacturer aims at increasing the service levels to 99% ...

- Question 98: Lean principle focuses on eliminating eight types of waste. ...

- Question 99: When designing the layout of a warehouse or stores area, one...

- Question 100: An organization might find it more beneficial to lease and u...

- Question 101: The managing director requires action to be taken to improve...

- Question 102: For which of the following is the 'delphi method' used?...

- Question 103: In a manufacturing organization, which of the following expl...

- Question 104: Under a Hire Purchase Agreement, ownership is transferred to...

- Question 105: A food processing manufacturer must be able to trace the ing...

- Question 106: What term describes a method used to account for inventory, ...

- Question 107: Which of the following are most likely the benefits of using...

- Question 108: MRP software is a powerful tool for managing material requir...

- Question 109: Which of the following are the key elements of total product...

- Question 110: Which of the following factors can be considered when select...

- Question 111: A major investment bank is planning to purchase a complex ba...

- Question 112: Which ONE of the following correctly differentiates between ...

- Question 113: Which of the following code systems is commonly used by gove...

- Question 114: Long-term forecasting of demand using a subjective method is...

- Question 115: When accounting for the disposal of fixed assets, the gain o...

- Question 116: A restaurant needs to buy a new freezer. The owner applies t...

- Question 117: PPC Refinery (UK) must close down an out-of-date refinery wh...

- Question 118: Which of the following statements represent a definition for...

- Question 119: Which of the following are essential aspects that are requir...

- Question 120: The term triple bottom line refers to a method for organizat...

- Question 121: Which of the following statements is true of just-in-time (J...