- Home

- PRMIA

- Exam I: Finance Theory Financial Instruments Financial Markets - 2015 Edition

- PRMIA.8006.v2021-04-25.q101

- Question 58

Valid 8006 Dumps shared by ExamDiscuss.com for Helping Passing 8006 Exam! ExamDiscuss.com now offer the newest 8006 exam dumps, the ExamDiscuss.com 8006 exam questions have been updated and answers have been corrected get the newest ExamDiscuss.com 8006 dumps with Test Engine here:

Access 8006 Dumps Premium Version

(290 Q&As Dumps, 35%OFF Special Discount Code: freecram)

<< Prev Question Next Question >>

Question 58/101

The yield offered by a bond with 18 months remaining to maturity is 5%. The coupon is 3%, paid semi-annually, and there are two more coupon payments to go in addition to the interest payment made at maturity. The zero rate for 6 months is 2%, that for 12 months is 3%. What is the 18 month zero rate?

Correct Answer: B

Explanation

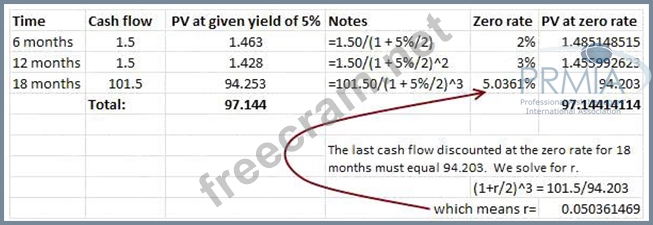

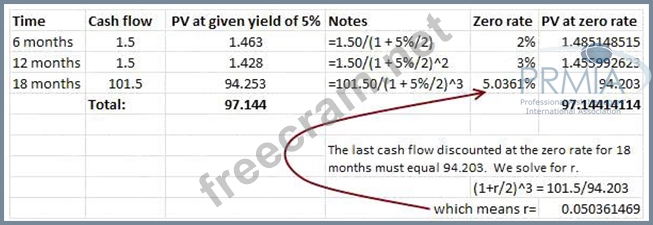

This is a two step problem:

First, calculate the bond price using the yield information, then

Second, once you know the bond price, calculate the 18 month zero rate using the bootstrap method.

Step 1: Bond valuation: All variables required for pricing the bond are known. The coupon payments will be

$1.50 in 6 months and 1 year from now, and a final paymento of $101.50 will be received in an year's time.

This can be discounted at the yield provided as follows, and summed together to get the bond price of $97.14.

Step 2: Boot strapping: Discount the 6 month and 12 month coupons at the zero rates for those periods, and subtract the total of these PVs from the bond price. These work out to 1.5/(1+2%/2) = 1.485, and

1.5/(1+3%/2)^2=1.456. That gives us the present value, $97.14 - $1.485 - 1.456 = $94.203, which grows to the final payment of $101.50 at the end of 18 months. The zero rate inherent in this price can then be worked out as we know that (1+r/2)^3 = 101.5/94.203, or r = 5.03%.

This is a two step problem:

First, calculate the bond price using the yield information, then

Second, once you know the bond price, calculate the 18 month zero rate using the bootstrap method.

Step 1: Bond valuation: All variables required for pricing the bond are known. The coupon payments will be

$1.50 in 6 months and 1 year from now, and a final paymento of $101.50 will be received in an year's time.

This can be discounted at the yield provided as follows, and summed together to get the bond price of $97.14.

Step 2: Boot strapping: Discount the 6 month and 12 month coupons at the zero rates for those periods, and subtract the total of these PVs from the bond price. These work out to 1.5/(1+2%/2) = 1.485, and

1.5/(1+3%/2)^2=1.456. That gives us the present value, $97.14 - $1.485 - 1.456 = $94.203, which grows to the final payment of $101.50 at the end of 18 months. The zero rate inherent in this price can then be worked out as we know that (1+r/2)^3 = 101.5/94.203, or r = 5.03%.

- Question List (101q)

- Question 1: What is the day count convention used for US government bond...

- Question 2: Backwardation in commodity futures is explained by:...

- Question 3: A trader finds that a stock index is trading at 1000, and a ...

- Question 4: Which of the following statements is true in relation to the...

- Question 5: A and B are two stocks with normally distributed returns. Th...

- Question 6: [According to the PRMIA study guide for Exam 1, Simple Exoti...

- Question 7: Which of the following statements are true:...

- Question 8: How are foreign exchange futures quoted against the US dolla...

- Question 9: Arrange the following rates in descending order, assuming an...

- Question 10: Callable corporate bonds:

- Question 11: Continuously compounded returns for an asset that increases ...

- Question 12: Which of the following statements are true in respect of a f...

- Question 13: The price of an interest rate cap is determined by: I. The p...

- Question 14: Which of the following is true about the early exercise of a...

- Question 15: Which of the following statements are true: I. Caps allow th...

- Question 16: Which of the following statements is INCORRECT according to ...

- Question 17: Which of the following statements are true: I. A credit defa...

- Question 18: It is January and an Australian importer needs to pay USD 1,...

- Question 19: A borrower who fears a rise in interest rates and wishes to ...

- Question 20: Security A and B both have expected returns of 10%, but the ...

- Question 21: Gamma risk can be hedged by:

- Question 22: If the continuously compounded risk free rate is 4% per year...

- Question 23: If r be the yield of a bond, which of the following relation...

- Question 24: The vast majority of exchange traded futures contracts are:...

- Question 25: Which of the following statements is INCORRECT according to ...

- Question 26: Which of the following statements are true? I. Macaulay dura...

- Question 27: Which of the following best describes a 'when-issued' market...

- Question 28: Where futures are being used to hedge a commodities position...

- Question 29: What would be the most profitable strategy for an investor w...

- Question 30: A stock is selling at $90. An investor writes a covered call...

- Question 31: When considering an appropriate mix of debt and equity, Chie...

- Question 32: Which of the following is NOT a historical event which serve...

- Question 33: The yield to maturity for a zero coupon bond is equivalent t...

- Question 34: Which of the following statements are true: I. Protective pu...

- Question 35: Which of the following describes the efficient frontier most...

- Question 36: [According to the PRMIA study guide for Exam 1, Simple Exoti...

- Question 37: Theta for a call option:

- Question 38: What kind of a risk attitude does a utility function with an...

- Question 39: Which of the following statements are true: I. Forward price...

- Question 40: According to the mean-variance criterion, which of the follo...

- Question 41: A 'short squeeze' refers to a situation where...

- Question 42: Calculate the net payment due on a fixed-for-floating intere...

- Question 43: How will the Macaulay duration of a 10 year coupon bearing b...

- Question 44: An investor in mortgage backed securities can hedge his/her ...

- Question 45: [According to the PRMIA study guide for Exam 1, Simple Exoti...

- Question 46: The gamma in a commodity futures contract is:...

- Question 47: [According to the PRMIA study guide for Exam 1, Simple Exoti...

- Question 48: Suppose the S&P is trading at a level of 1000. Using con...

- Question 49: A floating rate note pays daily overnight LIBOR. It matures ...

- Question 50: What is the delta of a forward contract on a non-dividend pa...

- Question 51: A bond has a Macaulay duration of 6 years. The yield to matu...

- Question 52: Which of the following assumptions underlie the 'square root...

- Question 53: Which of the following statements is a correct description o...

- Question 54: Buying an option on a futures contract requires:...

- Question 55: Which of the following relationships are true: I. Delta of P...

- Question 56: The two components of risk in a commodities futures portfoli...

- Question 57: Which of the following statements are true: I. Cash markets ...

- Question 58: The yield offered by a bond with 18 months remaining to matu...

- Question 59: Which of the following cause convexity to increase: I. Incre...

- Question 60: For a deep in-the-money option:...

- Question 61: [According to the PRMIA study guide for Exam 1, Simple Exoti...

- Question 62: Which of the following will have a higher reinvestment risk ...

- Question 63: Which of the following are true: I. A interest rate cap is e...

- Question 64: What is the approximate delta of an exactly at-the-money cal...

- Question 65: [According to the PRMIA study guide for Exam 1, Simple Exoti...

- Question 66: The forward price of a physical asset is affected by:...

- Question 67: Which of the following statements are true: I. An yield curv...

- Question 68: The transformation line has a y-intercept equal to...

- Question 69: The spot exchange rate between USD and AUD is 0.70. The risk...

- Question 70: The LIBOR square swap offers the square of the interest rate...

- Question 71: An investor holds $1m in a 10 year bond that has a basis poi...

- Question 72: An investor has a portfolio with a value of $1,000,000 and a...

- Question 73: For a pair of correlated assets, the achievable portfolio st...

- Question 74: Which of the following statements is not correct with respec...

- Question 75: If interest rates and spot prices stay the same, an increase...

- Question 76: A futures contract is quoted at 105. Which is the cheapest-t...

- Question 77: Calculate the number of S&P futures contracts to sell to...

- Question 78: Backwardation can happen in markets where...

- Question 79: Assuming all other factors remain the same, an increase in t...

- Question 80: When comparing compound interest rates to equivalent continu...

- Question 81: A bank holding a basket of credit sensitive securities trans...

- Question 82: Which of the following statements are true: I. The swap rate...

- Question 83: Determine the price of a 3 year bond paying a 5% coupon. The...

- Question 84: According to the CAPM, the expected return from a risky asse...

- Question 85: A) (Exhibit) B) (Exhibit) C) (Exhibit) D) (Exhibit)...

- Question 86: Which of the following is one of the basic axioms on which t...

- Question 87: When hedging one fixed income security with another, the hed...

- Question 88: Caps, floors and collars are instruments designed to:...

- Question 89: Which of the following statements are true: (I). A deep in-t...

- Question 90: The volatility of commodity futures prices is affected by...

- Question 91: Which of the following statements are true: I. The convexity...

- Question 92: Imagine two perpetual bonds, ie bonds that pay a coupon till...

- Question 93: For a portfolio of equally weighted uncorrelated assets, whi...

- Question 94: A bond with a 5% coupon trades at 95. An increase in interes...

- Question 95: Backwardation can be explained by:...

- Question 96: If the delta of a call option is 0.3, what is the delta of t...

- Question 97: A refiner may use which of the following instruments to simu...

- Question 98: If the implied volatility for a call option is 30%, the impl...

- Question 99: A bank advertises its certificates of deposits as yielding a...

- Question 100: A company has a long term loan from a bank at a fixed rate o...

- Question 101: A normal yield curve is generally:...