- Home

- Microsoft

- Microsoft Dynamics 365 Finance Functional Consultant

- Microsoft.MB-310.v2023-07-21.q139

- Question 16

Valid MB-310 Dumps shared by ExamDiscuss.com for Helping Passing MB-310 Exam! ExamDiscuss.com now offer the newest MB-310 exam dumps, the ExamDiscuss.com MB-310 exam questions have been updated and answers have been corrected get the newest ExamDiscuss.com MB-310 dumps with Test Engine here:

Access MB-310 Dumps Premium Version

(445 Q&As Dumps, 35%OFF Special Discount Code: freecram)

<< Prev Question Next Question >>

Question 16/139

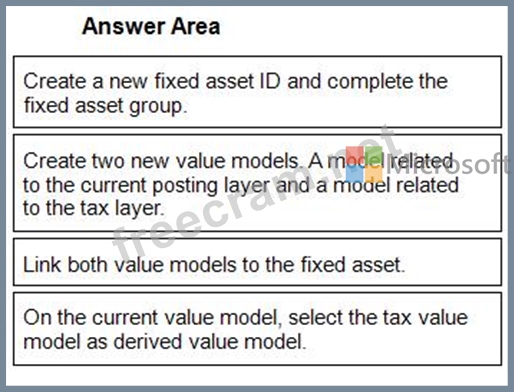

A company uses Microsoft Dynamics 365 Finance.

You receive a new purchase invoice. You must process the invoice as a fixed asset that complies with applicable tax regulations. Double entry is not permitted for asset acquisitions.

You need to configure the asset and books.

Which four actions should you recommend be performed in sequence? To answer move all actions from the list of actions to the answer area and arrange them m the correct order.

You receive a new purchase invoice. You must process the invoice as a fixed asset that complies with applicable tax regulations. Double entry is not permitted for asset acquisitions.

You need to configure the asset and books.

Which four actions should you recommend be performed in sequence? To answer move all actions from the list of actions to the answer area and arrange them m the correct order.

Correct Answer:

1 - Create a new fixed asset ID and complete the fixed asset group.

2 - Create two new value models. A model related to the current posting layer and a model related to the tax layer.

3 - Link both value models to the fixed asset.

4 - On the current value model, select the tax value model as derived value model.

- Question List (139q)

- Question 1: A customer implements Dynamics 365 Finance. The customer obs...

- Question 2: A rental service company with complex accrual requirements h...

- Question 3: You need to create Trey Research s bank accounts. Which thre...

- Question 4: You are a controller in an organization. You are identifying...

- Question 5: A company has delinquent customers. You need to configure Dy...

- Question 6: You are a Dynamics 365 Finance and Operations functional con...

- Question 7: An organization uses Dynamics 365 for Finance and Operations...

- Question 8: You work for a company that receives invoices in foreign cur...

- Question 9: You are configuring the Accounts payable module for a compan...

- Question 10: Note: This question is part of a series of questions that pr...

- Question 11: You work for a company that receives invoices in foreign cur...

- Question 12: You need to determine the root cause for User1's issue. Whic...

- Question 13: You need to configure the system to for existing purchasing ...

- Question 14: A company implements basic budgeting functionality in Dynami...

- Question 15: A client wants to ensure that transactions posted to the Gen...

- Question 16: A company uses Microsoft Dynamics 365 Finance. You receive a...

- Question 17: A client observes that some customers are late paying their ...

- Question 18: You need to set up legal entity currencies and conversions i...

- Question 19: You need to configure ledger allocations to meet the require...

- Question 20: You are a controller for a public sector organization. You n...

- Question 21: A client needs to configure Accounts payment vendor methods ...

- Question 22: You are implementing Dynamics 365 Finance. A new product is ...

- Question 23: Users are posting project transactions and bank transactions...

- Question 24: You are creating a budget for an organization. The organizat...

- Question 25: A private sector client needs item groups set up to support ...

- Question 26: A company needs to create budget plan templates for its budg...

- Question 27: You need to assist User3 with generating a deposit slip to m...

- Question 28: An organization sells monthly service subscriptions. The org...

- Question 29: You need to configure system functionality for pickle type r...

- Question 30: You are setting up the Accounts payable module and vendor in...

- Question 31: A client plans to use Dynamics 365 for Finance and Operation...

- Question 32: You need to prevent a reoccurrence of User2's issue. How sho...

- Question 33: A client plans to use financial statements in Dynamics 365 F...

- Question 34: You need to recommend a solution to prevent User3's issue fr...

- Question 35: You need to configure an Accounts payable charge for freight...

- Question 36: Which configuration makes it possible for User4 to make a pu...

- Question 37: A client is using the budget planning process in Dynamics 36...

- Question 38: You are creating a budget for an organization. The organizat...

- Question 39: You need to configure an Accounts payable charge for freight...

- Question 40: A private sector client needs item groups set up to support ...

- Question 41: You are a Dynamics 365 Finance expert for an organization. Y...

- Question 42: You need to recommend a solution to prevent User3's issue fr...

- Question 43: A client has Accounts payable invoices in their legg entity ...

- Question 44: A client wants to use Dynamics 365 Finance invoice validatio...

- Question 45: An organization acquires a building. You need to register an...

- Question 46: A company has delinquent customers. You need to configure Dy...

- Question 47: Note: This question is part of a series of questions that pr...

- Question 48: A company manufactures air filtering units few industrial ma...

- Question 49: You are a functional consultant for Contoso Entertainment Sy...

- Question 50: A client needs to configure Accounts payment vendor methods ...

- Question 51: A company is using vendors to produce components for its pro...

- Question 52: A client plans to use financial statements in Dynamics 365 F...

- Question 53: You are configuring the Fixed assets module for a Dynamics 3...

- Question 54: A company plans to use Dynamics 365 for Finance and Operatio...

- Question 55: You are configuring budgeting components in Dynamics 365 Fin...

- Question 56: Note: This question is part of a series of questions that pr...

- Question 57: You are creating a payment proposal that shows invoices that...

- Question 58: A customer implements Dynamics 365 Finance. The customer obs...

- Question 59: A client wants to ensure that transactions posted to the Gen...

- Question 60: A client wants to use Dynamics 365 Finance invoice validatio...

- Question 61: A client uses the standard trial balance in Dynamics 365 Fin...

- Question 62: You are creating a budget for an organization. The organizat...

- Question 63: You are a functional consultant for Contoso Entertainment Sy...

- Question 64: You are implementing a Dynamics 365 for Finance and Operatio...

- Question 65: A client plans to use the cost accounting module in Dynamics...

- Question 66: You are the accounts receivable manager of an organization. ...

- Question 67: A company provides employee life insurance to all full-time ...

- Question 68: You are a functional consultant for Contoso Entertainment Sy...

- Question 69: You need to recommend a solution to prevent User3's issue fr...

- Question 70: You are configuring budgeting components in Dynamics 365 for...

- Question 71: You are implementing a Dynamics 365 for Finance and Operatio...

- Question 72: You are a controller in an organization. You are identifying...

- Question 73: A client has Accounts payable invoices in their legal entity...

- Question 74: A retail company has outlets in multiple locations. Taxes va...

- Question 75: You need to configure the system to meet the fiscal year req...

- Question 76: A public sector organization wants to set up the derived fin...

- Question 77: A client is using the budget planning process in Dynamics 36...

- Question 78: A company is using vendors to produce components for its pro...

- Question 79: You are configuring the Accounts payable module for a compan...

- Question 80: A company plans to use Dynamics 365 for Finance and Operatio...

- Question 81: An organization plans to use defined journal names for each ...

- Question 82: Note: This question is part of a series of questions that pr...

- Question 83: A customer uses the sales tax functionality in Dynamics 365 ...

- Question 84: You are setting up a budget plan to accurately portray the p...

- Question 85: You are a functional consultant for Contoso Entertainment Sy...

- Question 86: You are implementing Dynamics 365 Finance. The company charg...

- Question 87: A client plans to use Dynamics 365 for Finance and Operation...

- Question 88: You are the controller for an organization. The company purc...

- Question 89: You need to prevent a reoccurrence of User2's issue. How sho...

- Question 90: Note: This question is part of a series of questions that pr...

- Question 91: A rental service company hires you to configure their system...

- Question 92: You need to process expense allocations. Which features shou...

- Question 93: You are implementing a Dynamics 365 for Finance and Operatio...

- Question 94: You are a Dynamics 365 Finance expert for an organization. Y...

- Question 95: A client plans to use the cost accounting module in Dynamics...

- Question 96: A client is implementing fixed assets in Dynamics 365 Financ...

- Question 97: A customer plans to implement invoice validation policies. Y...

- Question 98: A client has unique accounting needs that sometimes require ...

- Question 99: An organization plans to use defined journal names for each ...

- Question 100: You are setting up a budget plan to accurately portray the p...

- Question 101: A company has delinquent customers. You need to configure Dy...

- Question 102: Users are posting project transactions and bank transactions...

- Question 103: A client plans to use the cost accounting module in Dynamics...

- Question 104: You need to configure invoice validation for vendors in Dyna...

- Question 105: Note: This question is part of a series of questions that pr...

- Question 106: You are creating a budget for an organization. The organizat...

- Question 107: Note: This question is part of a series of questions that pr...

- Question 108: A client wants to ensure that transactions posted to the Gen...

- Question 109: A company plans to create a new allocation rule for electric...

- Question 110: You are a functional consultant for Contoso Entertainment Sy...

- Question 111: You need to configure the system to resolve User8's issue. W...

- Question 112: You must configure journal controls in Dynamics 365 for Fina...

- Question 113: A client plans to use the cost accounting module in Dynamics...

- Question 114: You are setting up main accounts in Dynamics 365 for Finance...

- Question 115: You are a functional consultant for Contoso Entertainment Sy...

- Question 116: A food manufacturer uses commodities such as beans, corn, an...

- Question 117: You are a Dynamics 365 Finance consultant. You are currently...

- Question 118: You are configuring vendor collaboration security roles for ...

- Question 119: A client confirms a safes order in Dynamics 365 for Finance ...

- Question 120: Note: This question is part of a series of questions that pr...

- Question 121: A client confirms a safes order in Dynamics 365 for Finance ...

- Question 122: A company sells goods to a customer. You enter an invoice fo...

- Question 123: You are configuring automatic bank reconciliation functional...

- Question 124: You need to validate the sales tax postings for Tennessee an...

- Question 125: A client is implementing fixed assets in Dynamics 365 Financ...

- Question 126: A client confirms a safes order in Dynamics 365 for Finance ...

- Question 127: A client is using Dynamics 365 Finance for sales order proce...

- Question 128: You are configuring budgeting components in Dynamics 365 for...

- Question 129: You need to select the functionality to meet the requirement...

- Question 130: You need to prevent a reoccurrence of User2's issue. How sho...

- Question 131: After you answer a question in this section, you will NOT be...

- Question 132: You are configuring vendor collaboration security roles for ...

- Question 133: A client wants to ensure that transactions posted to the Gen...

- Question 134: You need to configure the budgeting module to meet Fourth Co...

- Question 135: A company has many customers who are not paying invoices on ...

- Question 136: You are setting up a budget plan to accurately portray the p...

- Question 137: A client is implementing fixed assets in Dynamics 365 Financ...

- Question 138: A client has Accounts payable invoices in their legal entity...

- Question 139: You must configure journal controls in Dynamics 365 for Fina...