- Home

- Microsoft

- Microsoft Dynamics 365 Finance Functional Consultant

- Microsoft.MB-310.v2023-01-11.q82

- Question 47

Valid MB-310 Dumps shared by ExamDiscuss.com for Helping Passing MB-310 Exam! ExamDiscuss.com now offer the newest MB-310 exam dumps, the ExamDiscuss.com MB-310 exam questions have been updated and answers have been corrected get the newest ExamDiscuss.com MB-310 dumps with Test Engine here:

Access MB-310 Dumps Premium Version

(445 Q&As Dumps, 35%OFF Special Discount Code: freecram)

<< Prev Question Next Question >>

Question 47/82

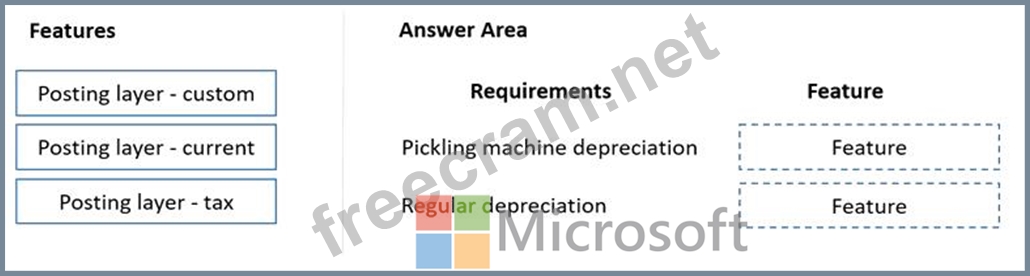

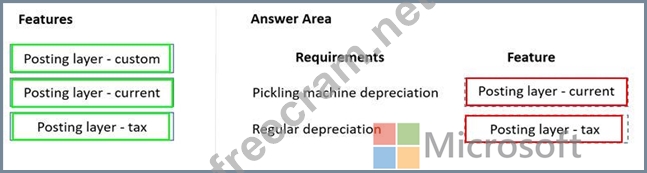

You need to select the functionality to meet the requirement.

Which features should you use? To answer, drag the appropriate features to the correct requirements. Each feature may be used once or not at all. You may need to drag the split bar between panes or scroll to view content.

NOTE: Each correct selection is worth one point.

Which features should you use? To answer, drag the appropriate features to the correct requirements. Each feature may be used once or not at all. You may need to drag the split bar between panes or scroll to view content.

NOTE: Each correct selection is worth one point.

Correct Answer:

Reference:

https://www.mscloudexperts.com/how-to-set-up-fixed-assets-to-register-transactions-in-posting-layers/

Topic 2, Fourth Coffee

Current environment

Systemwide setup

Dynamics 365 Finance in Microsoft Azure is used to manage the supply chain, retail, and financials.

All companies share a Chart of Accounts.

Two dimensions are used: Department and Division.

Budgeting is controlled at the department level.

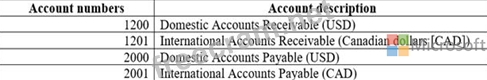

Customers and vendors are defined as two groups: Domestic and International.

Mandatory credit check is set to No.

Consolidate online is used for the consolidation of all companies.

International main accounts are subject to foreign currency revaluation.

The purchasing budget is used to enforce purchasing limits.

General ledger accounts

Fourth Coffee

The base currency is USD.

Three item groups are used: coffee, supplies, and nonstock.

The standard sales tax method is used.

Acquiring fixed assets requires a purchase order.

All customer payment journals require a deposit slip.

CustomerX is a taxable company.

CustomerY is a tax-exempt company.

CustomerZ is a taxable company.

CompanyA

The base currency is USD.

It consists of a marketing department and a digital division.

A 4-5-4 calendar structure is used.

The standard sales tax method is used.

CompanyB

The base currency is CAD.

The conditional sales tax method is used.

Requirements

Reporting

A consolidated Fourth Coffee financial report is required in USD currency.

Fourth Coffee and its subsidiaries need to be able to report sales by item type.

Year-end adjustments need to be reported separately in a different period to view financial reporting inclusive and exclusive of year-end adjustments.

Issues

User1 observes that a General journal was used in error to post to the Domestic Accounts Receivable trade account.

User2 has to repeatedly reclassify vendor invoice journals in Fourth Coffee Company that are posted to the marketing department and digital division.

When User3 posts an Accounts receivable payment journal, a deposit slip is not generated.

User4 observes an increase in procurement department expenses for supplies.

User5 observes that sales tax is not calculating on a sales order for CustomerZ.

User6 observes that sales tax is calculating for CustomerY.

User7 observes that the sales tax payment report is excluding posted invoice transactions.

User8 in CompanyA attempts to set up the sales tax receivable account on the sales tax posting form.

User9 in CompanyA needs to purchase three tablets by using a purchase order and record the devices as fixed assets.

CustomerX requires a credit check when making a purchase and is currently at their credit limit.

- Question List (82q)

- Question 1: You need to ensure accounting entries are transferred from s...

- Question 2: A customer implements Dynamics 365 Finance. The customer obs...

- Question 3: A private sector client needs item groups set up to support ...

- Question 4: You need to configure credit card processing for all three c...

- Question 5: Manual entry of currency exchange rates must be discontinued...

- Question 6: You need to configure ledger allocations to meet the require...

- Question 7: A customer implements Dynamics 365 Finance You need to confi...

- Question 8: A public sector organization wants to set up the derived fin...

- Question 9: A company uses Microsoft Dynamics 365 finance to manage cust...

- Question 10: D18912E1457D5D1DDCBD40AB3BF70D5D A customer uses the sales t...

- Question 11: You need to configure the budgeting module to meet Fourth Co...

- Question 12: A client is using Dynamics 365 Finance for sales order proce...

- Question 13: You need to reconfigure the taxing jurisdiction for Humongou...

- Question 14: A company implements baste budgeting functionality in Dynami...

- Question 15: You are a functional consultant for Contoso Entertainment Sy...

- Question 16: You are a functional consultant for Contoso Entertainment Sy...

- Question 17: You need to prevent a reoccurrence of User2's issue. How sho...

- Question 18: You need to configure the system to for existing purchasing ...

- Question 19: You are a consultant who is implementing Dynamics 365 Financ...

- Question 20: You need to identify the root cause for the error that User5...

- Question 21: You need to configure revenue recognition to meet the requir...

- Question 22: A rental service company with complex accrual requirements h...

- Question 23: You are a functional consultant for Contoso Entertainment Sy...

- Question 24: Note: This question is part of a series of questions that pr...

- Question 25: You must configure journal controls in Dynamics 365 for Fina...

- Question 26: You are setting up the Accounts payable module and vendor in...

- Question 27: You are using Microsoft Dynamics 365 finance You need to acq...

- Question 28: You need to configure credit card processing for all three c...

- Question 29: A client uses Dynamics 365 for Finance and Operations for ac...

- Question 30: You are configuring intercompany accounting for a multicompa...

- Question 31: You are configuring the Fixed assets module for a Dynamics 3...

- Question 32: A food manufacturer uses commodities such as beans, corn, an...

- Question 33: Note: This question is part of a series of questions that pr...

- Question 34: You need to set up legal entity currencies and conversions i...

- Question 35: A company uses Microsoft Dynamics 365 Finance. You receive a...

- Question 36: A client wants Dynamics 365 Finance to calculate sales tax o...

- Question 37: A client plans to use financial statements in Dynamics 365 F...

- Question 38: The Canadian franchise purchases excess ski equipment from t...

- Question 39: You need to ensure Trey Research meets the compliance requir...

- 1 commentQuestion 40: The posting configuration for a purchase order is shown as f...

- Question 41: Note: This question is part of a series of questions that pr...

- Question 42: You need to view the results of Fourth Coffee Holding Compan...

- Question 43: You work for a company that receives invoices in foreign cur...

- Question 44: You are configuring Dynamics 365 for Finance and Operations,...

- Question 45: An organization is setting up cost accounting. You need to s...

- Question 46: A company is preparing to complete yearly budgets. The compa...

- Question 47: You need to select the functionality to meet the requirement...

- Question 48: You need to address the employees issue regarding expense re...

- Question 49: A company implements basic budgeting functionality in Dynami...

- Question 50: A company configures budget controls at the beginning of the...

- Question 51: Note: This question is part of a series of questions that pr...

- Question 52: You are configuring account structures and advanced rules in...

- Question 53: A client has multiple legal entities set up in Dynamics 365 ...

- Question 54: An organization sells monthly service subscriptions. The org...

- 1 commentQuestion 55: You are implementing Dynamics 365 Finance. The company charg...

- Question 56: You need to setup a process of tracking, recording, and anal...

- Question 57: You are a Dynamics 365 Finance and Operations functional con...

- Question 58: You are the controller for an organization. The company purc...

- Question 59: You need to recommend a solution to prevent User3's issue fr...

- Question 60: You are creating a payment proposal that shows invoices that...

- Question 61: A company is preparing to complete a year-end close process....

- Question 62: You are a Dynamics 365 Finance consultant. You are currently...

- Question 63: A client has Accounts payable invoices in their legg entity ...

- Question 64: You need to configure currencies for the legal entities. How...

- Question 65: You plan to manage delinquent customers by monitoring the co...

- Question 66: A client has unique accounting needs that sometimes require ...

- Question 67: You are the purchase manager of an organization. You purchas...

- Question 68: You are asked to configure foreign currency revaluation in D...

- Question 69: You are creating a budget for an organization. The organizat...

- Question 70: You are a functional consultant for Contoso Entertainment Sy...

- Question 71: You are the accounts receivable manager of an organization. ...

- Question 72: Note: This question is part of a series of questions that pr...

- Question 73: Which configuration makes it possible for User4 to make a pu...

- Question 74: You need to configure invoice validation for vendors in Dyna...

- Question 75: A client has unique accounting needs that sometimes require ...

- Question 76: You need to validate the sales tax postings for Tennessee an...

- Question 77: A company uses Dynamics 365 Finance. The company induces sot...

- Question 78: You need to determine why CustomerX is unable to confirm ano...

- Question 79: A company is implementing Microsoft Dynamics 355 -Finance. T...

- Question 80: A company configures Dynamics 36S Finance to collect and rep...

- Question 81: A client is implementing the Budgeting module in Dynamics 36...

- Question 82: You need to process expense allocations. Which features shou...