Valid CSC2 Dumps shared by ExamDiscuss.com for Helping Passing CSC2 Exam! ExamDiscuss.com now offer the newest CSC2 exam dumps, the ExamDiscuss.com CSC2 exam questions have been updated and answers have been corrected get the newest ExamDiscuss.com CSC2 dumps with Test Engine here:

Access CSC2 Dumps Premium Version

(187 Q&As Dumps, 35%OFF Special Discount Code: freecram)

<< Prev Question Next Question >>

Question 28/49

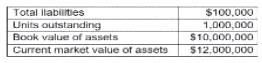

The following financial information is available for fund SKE:

What is SKE fund's net asset value per share?

What is SKE fund's net asset value per share?

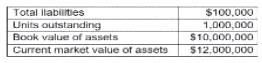

Correct Answer: B

A white sheet with black text Description automatically generated

Explanation of Answer Options:

* Option A ($9.90): Incorrect; this value does not reflect the subtraction of liabilities.

* Option B ($11.90): Correct; it accounts for the subtraction of liabilities and proper division by outstanding units.

* Option C ($12.00): Incorrect; it represents the market value of assets per unit without deducting liabilities.

* Option D ($10.00): Incorrect; this value does not align with the given data or calculations.

References to Canadian Securities Course Exam 2 Study Materials:

* Volume 2, Chapter 17- Mutual Funds: Structure and Regulation, Pricing Mutual Fund Units:

* Discusses the formula for calculating NAV per share, including the treatment of liabilities and market value of assets.

* Volume 2, Chapter 22- Other Managed Products:

* Covers the concept of valuation for managed funds and its importance for accurate pricing.

* Volume 1, Chapter 11- Corporations and Their Financial Statements:

* Provides foundational knowledge about book and market values used in calculations.

Explanation of Answer Options:

* Option A ($9.90): Incorrect; this value does not reflect the subtraction of liabilities.

* Option B ($11.90): Correct; it accounts for the subtraction of liabilities and proper division by outstanding units.

* Option C ($12.00): Incorrect; it represents the market value of assets per unit without deducting liabilities.

* Option D ($10.00): Incorrect; this value does not align with the given data or calculations.

References to Canadian Securities Course Exam 2 Study Materials:

* Volume 2, Chapter 17- Mutual Funds: Structure and Regulation, Pricing Mutual Fund Units:

* Discusses the formula for calculating NAV per share, including the treatment of liabilities and market value of assets.

* Volume 2, Chapter 22- Other Managed Products:

* Covers the concept of valuation for managed funds and its importance for accurate pricing.

* Volume 1, Chapter 11- Corporations and Their Financial Statements:

* Provides foundational knowledge about book and market values used in calculations.

- Question List (49q)

- Question 1: What type of investment typically involves massive amounts o...

- Question 2: What is a disadvantage of fee-based accounts when compared t...

- Question 3: Franco purchased an ETF in his non-registered account, and h...

- Question 4: A business trust would typically purchase the underlying com...

- Question 5: What is the likely outcome at the end of a five-year term of...

- Question 6: What market condition is typically evident during the late c...

- Question 7: How can an analyst use trend analysis to analyze a company's...

- Question 8: A client who seeks advice from an investment advisor but doe...

- Question 9: A fixed-rate bond was originally priced at $100 and paid $5 ...

- Question 10: Which asset type is classified as a fixed-income asset for p...

- Question 11: What must happen for a redemption to be processed from a mut...

- Question 12: Which type of mutual funds tend to have the lowest managemen...

- Question 13: What is the key objective for investors in alternative strat...

- Question 14: Where would the description d a company's fixed assets norma...

- Question 15: What is one at the most important factors to determine how m...

- Question 16: What is the main pitfall of closet indexing for investors?...

- Question 17: Which factors tends to increase when inflation increases?...

- Question 18: A bond with a duration of five is currently priced at $103. ...

- Question 19: What is the measure of risk commonly applied to portfolio an...

- Question 20: What is a characteristic of provincial savings bonds?...

- Question 21: For what type of company is the dividend discount model leas...

- Question 22: What type of return is adjusted for inflation?...

- Question 23: Which exchange trades all financial and equity futures and o...

- Question 24: When a futures contract is entered into, who sets the minimu...

- Question 25: What is the normal shape of a yield curve?...

- Question 26: When considering the overall investment objectives of liquid...

- Question 27: Jerry sells Company A's regular bond because the thinks it i...

- Question 28: The following financial information is available for fund SK...

- Question 29: What information must be disclosed in ETF Facts documents th...

- Question 30: When considering management accounts, what is most accurate ...

- Question 31: How do the fees differ between an F-class and front-end vers...

- Question 32: What is a structured product?

- Question 33: What do technical analysis and fundamental analysis have in ...

- Question 34: What do the returns on treasury bills often represent?...

- Question 35: What type of risk were mortgage-backed securities designed t...

- Question 36: Which ratio gauges a company's ability to repay its debts us...

- Question 37: What are examples of primary investment objectives?...

- Question 38: What is the main benefit of investing in preferred shares?...

- Question 39: What type of return is calculated for a security held for 18...

- Question 40: What actions can a government take to lower a $40 billion na...

- Question 41: Which fiscal policy measure was designed to encourage indivi...

- Question 42: All things being equal and assuming a stable economy, which ...

- Question 43: What actions can a government take to lower a $40 billion na...

- Question 44: What is the difference between sinking funds and purchase fu...

- Question 45: Which will taxed at the taxpayer' marginal tax rate?...

- Question 46: In Canada, which industries are categorized as defensive?...

- Question 47: What is a characteristic of the FTSE Canada Universe Bond In...

- Question 48: Which type of sell side equity revenue is earned when a deal...

- Question 49: Why would a corporation choose to issue preferred shares rat...