- Home

- CIMA

- F3 Financial Strategy

- CIMA.F3.v2024-01-19.q182

- Question 91

Valid F3 Dumps shared by ExamDiscuss.com for Helping Passing F3 Exam! ExamDiscuss.com now offer the newest F3 exam dumps, the ExamDiscuss.com F3 exam questions have been updated and answers have been corrected get the newest ExamDiscuss.com F3 dumps with Test Engine here:

Access F3 Dumps Premium Version

(435 Q&As Dumps, 35%OFF Special Discount Code: freecram)

<< Prev Question Next Question >>

Question 91/182

Company ABE is an unlisted company that has been trading for 10 years. During this period, it has seen substantial growth in revenue and earnings. For the company to continue its growth it needs to raise new finance The directors are considering an initial public offering (IPO).

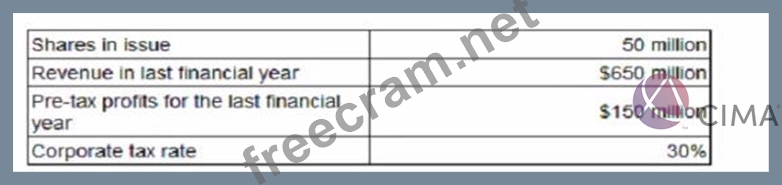

The following information is relevant to Company ABE:

A listed company of similar size and in the same industry as Company ABE had earnings per share in the last financial year of $1 80 Its shares are currently trading at a price / earnings ratio of 12.

The directors of Company ABE have asked for advice on what price they might expect if the company is listed on the stock exchange by means of an IPO.

Using the information provided what is an estimated issue price for each share in Company ABE?

Give your answer to 2 decimal places.

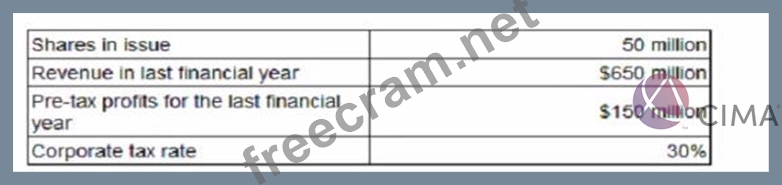

The following information is relevant to Company ABE:

A listed company of similar size and in the same industry as Company ABE had earnings per share in the last financial year of $1 80 Its shares are currently trading at a price / earnings ratio of 12.

The directors of Company ABE have asked for advice on what price they might expect if the company is listed on the stock exchange by means of an IPO.

Using the information provided what is an estimated issue price for each share in Company ABE?

Give your answer to 2 decimal places.

Correct Answer:

Pending

- Question List (182q)

- Question 1: A company has in a 5% corporate bond in issue on which there...

- Question 2: B has a S3 million loan outstanding on which the interested ...

- Question 3: A company has accumulated a significant amount of excess cas...

- Question 4: Company W has received an unwelcome takeover bid from Compan...

- Question 5: A listed company in a high growth industry, where innovation...

- Question 6: A major energy company, GDE, generates and distributes elect...

- Question 7: Company YZZ has made a bid for the entire share capital of C...

- Question 8: Company A is planning to acquire Company B. Company A's mana...

- Question 9: Clinic A provides free healthcare to all members of the comm...

- Question 10: A company is currently all-equity financed with a cost of eq...

- Question 11: An unlisted company operates in a niche market, exploring th...

- Question 12: Which TWO of the following situations offer arbitrage opport...

- Question 13: A company's gearing (measured as debt/(debt + equity)) is cu...

- Question 14: Company A has made an offer to take over all the shares in C...

- Question 15: BBA is a wholly owned subsidiary of AAB BBA operates in coun...

- Question 16: Company X is an established, unquoted company which provides...

- Question 17: WX, an advertising agency, has just completed the all-cash a...

- Question 18: The Board of Directors of a small listed company engaged in ...

- Question 19: A company's current earnings before interest and taxation ar...

- Question 20: The directors of the following four entities have been discu...

- Question 21: The directors of a unlisted manufacturing company have prepa...

- Question 22: A company proposes to value itself based on the net present ...

- Question 23: A is a listed company. Its shares trade on a stock market ex...

- Question 24: Which THREE of the following are the most likely exit routes...

- Question 25: A company is deciding whether to offer a scrip dividend or a...

- Question 26: HHH Company has a fixed rate loan at 10.0%, but wishes to sw...

- Question 27: PPP's home currency is the PS. An overseas customer is due t...

- Question 28: A company is deciding whether to offer a scrip dividend or a...

- Question 29: Company P is a pharmaceutical company listed on an alternati...

- Question 30: Which THREE of the following statements are disadvantages of...

- Question 31: Company A, a listed company, plans to acquire Company T, whi...

- Question 32: A company is preparing an integrated report according to the...

- Question 33: Which THREE of the following are considered in detail in IFR...

- Question 34: A company is planning a share repurchase programme with the ...

- Question 35: Company A is planning to acquire Company B by means of a cas...

- Question 36: An entity prepares financial statements to 30 June. During t...

- Question 37: A venture capitalist invests in a company by means of buying...

- Question 38: A company has: * A price/earnings (P/E) ratio of 10. * Earni...

- Question 39: A company plans to acquire new machinery. It has two financi...

- Question 40: PYP is a listed courier company. It is looking to raise new ...

- Question 41: Company M is a listed company in a highly technical service ...

- Question 42: A company is funded by: * $40 million of debt (market value)...

- Question 43: Company WWW is considering making a takeover bid for Company...

- Question 44: A company based in Country D, whose currency is the D$, has ...

- Question 45: Company HJK is planning to bid for listed company BNM Financ...

- Question 46: The financial assistant of a geared company has prepared the...

- Question 47: M is an accountant who wishes to take out a forward rate agr...

- Question 48: Company A plans to diversify by a cash acquisition of Compan...

- Question 49: A large, listed company in the food and household goods indu...

- Question 50: An unlisted company has the following data: (Exhibit) A list...

- Question 51: A company is based in Country Y whose functional currency is...

- Question 52: A national rail operating company has made an offer to acqui...

- Question 53: A company is considering hedging the interest rate risk on a...

- Question 54: VVV has a floating rate loan that it wishes to replace with ...

- Question 55: A company's gearing is well below its optimal level and ther...

- Question 56: Which of the following explains an aim of integrated reporti...

- Question 57: Company C is a listed company. It is currently considering t...

- Question 58: A private company was formed five years ago and is currently...

- Question 59: The Senior Management Team of ABC, an owner-managed, capital...

- Question 60: Company M plans to bid for Company J. Company M has 20 milli...

- Question 61: A large, listed company is planning a major project that sho...

- Question 62: Company AEE has a 10 year 6% corporate bond in issue which h...

- Question 63: Company A plans to acquire Company B in a 1-for-1 share exch...

- Question 64: Company A operates in country A and uses currency AS. It is ...

- Question 65: At the last financial year end, 31 December 20X1, a company ...

- Question 66: Company A is unlisted and all-equity financed. It is trying ...

- Question 67: Delta and Kappa both wish to borrow $50m. Delta can borrow a...

- Question 68: A venture capitalist is most likely to take which THREE of t...

- Question 69: A company's dividend policy is to pay out 50% of its earning...

- Question 70: A profitable company wishes to dispose of a loss-making divi...

- Question 71: A Venture Capital Fund currently holds a significant shareho...

- Question 72: Which of the following statements about IFRS 7 Financial Ins...

- Question 73: A company's statement of financial position includes non-cur...

- Question 74: A company based in Country D, whose currency is the D$, has ...

- Question 75: A consultancy company is dependent for profits and growth on...

- Question 76: A company has convertible bonds in issue. The following debt...

- Question 77: A listed company is planning a share repurchase. The followi...

- Question 78: When valuing an unlisted company, a P/E ratio for a similar ...

- Question 79: Company C has received an unwelcome takeover bid from Compan...

- Question 80: A company intends to sell one of its business units. Company...

- Question 81: KKL is a listed sports clothing company with three separate ...

- Question 82: Company T has 1,000 million shares in issue with a current s...

- Question 83: Where a company acquires another company, which THREE of the...

- Question 84: Select the category of risk for each of the descriptions bel...

- Question 85: Company P is a large unlisted food-processing company. Its c...

- Question 86: On 31 October 20X3: * A company expected to agree a foreign ...

- Question 87: A company's Board of Directors is assessing the likely impac...

- Question 88: A company's annual dividend has grown steadily at an annual ...

- Question 89: The shares of a company in a high technology industry have b...

- Question 90: The International Integrated Reporting Council (IIRC) was fo...

- Question 91: Company ABE is an unlisted company that has been trading for...

- Question 92: A company generates and distributes electricity and gas to h...

- Question 93: Company W is a manufacturing company with three divisions, a...

- Question 94: An unlisted company is attempting to value its equity using ...

- Question 95: A large, quoted company that is all-equity financed is plann...

- Question 96: A manufacturing company based in Country R. where the curren...

- Question 97: A company has a cash surplus which it wishes to distribute t...

- Question 98: A company is currently all-equity financed. The directors ar...

- Question 99: It is now 1 January 20X0. Company V, a private equity compan...

- Question 100: A company has 6 million shares in issue. Each share has a ma...

- Question 101: Listed Company A has prepared a valuation of an unlisted com...

- Question 102: A company is considering either exporting its product direct...

- Question 103: A company's directors plan to increase gearing to come in li...

- Question 104: A listed company is financed by debt and equity. If it incre...

- Question 105: Listed company R is in the process of making a cash offer fo...

- Question 106: Company Z wishes to borrow $50 million for 10 years at a fix...

- Question 107: The following information relates to Company ZZA's current c...

- Question 108: A company s about to announce a new project that has a posit...

- Question 109: A national airline has made an offer to acquire a smaller ai...

- Question 110: Which of the following would be a reason for a company to ad...

- Question 111: Company S is planning to acquire Company T. The shareholders...

- Question 112: A company has two divisions. A is the manufacturing division...

- Question 113: Which of the following best explains why the interest rate p...

- Question 114: A company is based in Country Y whose functional currency is...

- Question 115: Under traditional theory, an increase in a company's WACC wo...

- Question 116: Company A operates in country A with the AS as its functiona...

- Question 117: Company RRR is a well-established, unlisted, road freight co...

- Question 118: A listed company has suffered a period of falling revenues a...

- Question 119: Company R is a major food retailer. It wishes to acquire Com...

- Question 120: Company A plans to acquire Company B. Both firms operate as ...

- Question 121: Which THREE of the following statements about stock market l...

- Question 122: A company wishes to raise new finance using a rights issue t...

- Question 123: A company based in Country A with the A$ as its functional c...

- Question 124: Company ABD and Company BCD operate in the same industry and...

- Question 125: Company A, a listed company, plans to acquire Company T, whi...

- Question 126: An unlisted software development company has recently report...

- Question 127: A company enters into a floating rate borrowing with interes...

- Question 128: X exports goods to customers in a number of small countries ...

- Question 129: Which THREE of the following long term changes are most like...

- Question 130: On 31 October 20X3: * A company expected to agree a foreign ...

- Question 131: Company Y plans to diversify into an activity where Company ...

- Question 132: XCV can borrow at either 9.5% fixed or the risk-free rate pl...

- Question 133: Which TIIRCC of the following are most likely to reduce the ...

- Question 134: Company A is proposing a rights issue to finance a new inves...

- Question 135: A company plans to raise S15 million to finance an expansion...

- Question 136: PPA owns $500,000 of shares in Company ABB. Company ABB has ...

- Question 137: STU has relatively few tangible assets and is dependent for ...

- Question 138: ADC is planning to acquire DEF in order to benefit from the ...

- Question 139: The Board of Directors of a listed company have decided that...

- Question 140: A listed entertainment and media company produces and distri...

- Question 141: A company is wholly equity funded. It has the following rele...

- Question 142: Company B is an all equity financed company with a cost of e...

- Question 143: Company Z has identified four potential acquisition targets:...

- Question 144: A new company was set up two years ago using the personal fi...

- Question 145: The Board of Directors of Company T is considering a rights ...

- Question 146: Company XXY operates in country X with the X$ as its currenc...

- Question 147: An unlisted company wishes to obtain an estimated value for ...

- Question 148: Company A is a large well-established listed entertainment c...

- Question 149: A company's gearing (measured as debt/(debt + equity)) is cu...

- Question 150: An unlisted software development business is to be sold by i...

- Question 151: Company U has made a bid for the entire share capital of Com...

- Question 152: PTT has a number of subsidiary companies around the world, i...

- Question 153: Listed company R is in the process of making a cash offer fo...

- Question 154: Company M is a geared company whose equity has a market valu...

- Question 155: Company E is a listed company. Its directors are valuing a s...

- Question 156: Company A is planning to acquire Company B at a price of $ 6...

- Question 157: A company is owned by its five directors who want to sell th...

- Question 158: Company T is a listed company in the retail sector. Its curr...

- Question 159: The long-term prospects for inflation in the UK and the USA ...

- Question 160: Company ABC's management has noticed that Company BCD has qu...

- Question 161: TTT pic is a listed company. The following information is re...

- Question 162: A company plans to raise $12 million to finance an expansion...

- Question 163: A large, listed company in the food and household goods indu...

- Question 164: A listed company is planning a share repurchase. The followi...

- Question 165: A company raised fixed rate bank finance together with an in...

- Question 166: A listed publishing company owns a subsidiary company whose ...

- Question 167: An aerospace company is planning to diversify into car manuf...

- Question 168: XYZ is a multi-national group with subsidiary AA in Country ...

- Question 169: Company ACC. an ungeared car manufacturer has launched a tak...

- Question 170: A company is considering the issue of a convertible bond com...

- Question 171: A company plans to raise $12 million to finance an expansion...

- Question 172: RST wishes to raise at least $40 million of new equity by is...

- Question 173: The Treasurer of Z intends to use interest rate options to s...

- Question 174: SUP is a large supermarket chain. It produces many 'own bran...

- Question 175: Company J plans to acquire Company K, an unlisted company wh...

- Question 176: Company A plans to acquire Company B, an unlisted company wh...

- Question 177: The directors of a multinational group have decided to sell ...

- Question 178: A company has: * 10 million $1 ordinary shares in issue * A ...

- Question 179: A company is planning to issue a 5 year $100 million bond at...

- Question 180: Company M is a listed company in a highly technical service ...

- Question 181: A private company manufactures goods for export, the goods a...

- Question 182: On 1 January 20X1, a company had: * Cost of equity of 10 0%....