Valid CIMAPRA19-F03-1 Dumps shared by ExamDiscuss.com for Helping Passing CIMAPRA19-F03-1 Exam! ExamDiscuss.com now offer the newest CIMAPRA19-F03-1 exam dumps, the ExamDiscuss.com CIMAPRA19-F03-1 exam questions have been updated and answers have been corrected get the newest ExamDiscuss.com CIMAPRA19-F03-1 dumps with Test Engine here:

Access CIMAPRA19-F03-1 Dumps Premium Version

(435 Q&As Dumps, 35%OFF Special Discount Code: freecram)

<< Prev Question Next Question >>

Question 133/137

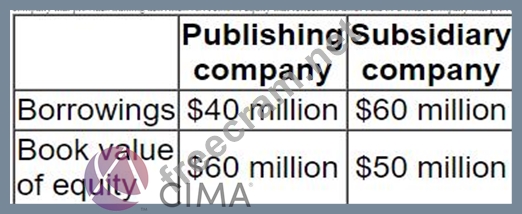

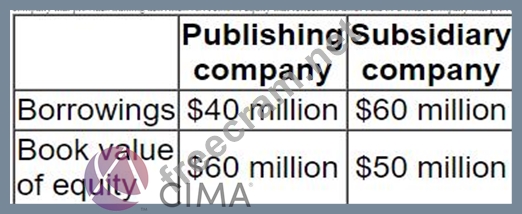

A listed publishing company owns a subsidiary company whose business activity is training.

It wishes to dispose of the subsidiary company.

The following information is available:

The board of the publishing company believe that the value of the subsidiary company, and hence the value of the equity invested in it, can be determined by calculating the present value of the subsidiary's free cashflows.

Which of the following is the most appropriate discount rate to use when determining the enterprise value of the company?

It wishes to dispose of the subsidiary company.

The following information is available:

The board of the publishing company believe that the value of the subsidiary company, and hence the value of the equity invested in it, can be determined by calculating the present value of the subsidiary's free cashflows.

Which of the following is the most appropriate discount rate to use when determining the enterprise value of the company?

Correct Answer: A

- Question List (137q)

- Question 1: Company H is considering the valuation of an unlisted compan...

- Question 2: An analyst has valued a company using the free cash flow val...

- Question 3: A profit-seeking company intends to acquire another company ...

- Question 4: Which TWO of the following statements about debt instruments...

- Question 5: XYZ is a multi-national group with subsidiary AA in Country ...

- Question 6: A listed company is planning a share repurchase. Research in...

- Question 7: Companies A, B, C and D: * are based in a country that uses ...

- Question 8: A listed company in the retail sector has accumulated excess...

- Question 9: Company A is proposing a rights issue to finance a new inves...

- Question 10: Company HJK is planning to bid for listed company BNM Financ...

- Question 11: Company X is based in Country A, whose currency is the A$. I...

- Question 12: A company plans to raise $12 million to finance an expansion...

- Question 13: X exports goods to customers in a number of small countries ...

- Question 14: Company A is a large well-established listed entertainment c...

- Question 15: A company has forecast the following results for the next fi...

- Question 16: A venture capitalist invests in a company by means of buying...

- Question 17: A company has a loss-making division that it has decided to ...

- Question 18: Company C has received an unwelcome takeover bid from Compan...

- Question 19: A company is reporting under IFRS 7 Financial Instruments: D...

- Question 20: A company's latest accounts show profit after tax of $20.0 m...

- Question 21: At the last financial year end, 31 December 20X1, a company ...

- Question 22: B has a S3 million loan outstanding on which the interested ...

- Question 23: A company has a cash surplus which it wishes to distribute t...

- Question 24: Company B is an all equity financed company with a cost of e...

- Question 25: A company plans to cut its dividend but is concerned that th...

- Question 26: A company's latest accounts show profit after tax of $20.0 m...

- Question 27: Company B is an all equity financed company with a cost of e...

- Question 28: An unlisted company wishes to obtain an estimated value for ...

- Question 29: Company A plans to acquire Company B in a 1-for-1 share exch...

- Question 30: A company gas a large cash balance but its directors have be...

- Question 31: A company's gearing is well below its optimal level and ther...

- Question 32: A company wishes to raise new finance using a rights issue t...

- Question 33: A profitable company wishes to dispose of a loss-making divi...

- Question 34: Company A plans to diversify by a cash acquisition of Compan...

- Question 35: A company wishes to raise new finance using a rights issue t...

- Question 36: An entity prepares financial statements to 30 June. During t...

- Question 37: A UK company enters into a 5 year borrowing with bank P at a...

- Question 38: Extracts from a company's profit forecast for the next finan...

- Question 39: A company is concerned that a high proportion of its debt po...

- Question 40: Company T has 1,000 million shares in issue with a current s...

- Question 41: HHH Company has a fixed rate loan at 10.0%, but wishes to sw...

- Question 42: Company C has received an unwelcome takeover bid from Compan...

- Question 43: Company S is planning to acquire Company T. The shareholders...

- Question 44: Company P is a large unlisted food-processing company. Its c...

- Question 45: Providers of debt finance often insist on covenants being en...

- Question 46: Company X plans to acquire Company Y. Pre-acquisition inform...

- Question 47: A company is preparing an integrated report according to the...

- Question 48: A company is wholly equity funded. It has the following rele...

- Question 49: A company is currently all-equity financed. The directors ar...

- Question 50: CI IJ has decided to move its production plant to overseas c...

- Question 51: On 1 January: * Company X has a value of $50 million * Compa...

- Question 52: A listed company is financed by debt and equity. If it incre...

- Question 53: Company A, a listed company, plans to acquire Company T, whi...

- Question 54: A company intends to sell one of its business units. Company...

- Question 55: AA is considering changing its capital structure. The follow...

- Question 56: A company's main objective is to achieve an average growth i...

- Question 57: A private company was formed five years ago and is currently...

- Question 58: G purchased a put option that grants the right to cap the in...

- Question 59: A national rail operating company has made an offer to acqui...

- Question 60: Company X is based in Country A, whose currency is the A$. I...

- Question 61: The Board of Directors of a small listed company engaged in ...

- Question 62: A company is currently all-equity financed. The directors ar...

- Question 63: A listed publishing company owns a subsidiary company whose ...

- Question 64: An unlisted company. * Is owned by the original founders and...

- Question 65: KKL is a listed sports clothing company with three separate ...

- Question 66: Company WWW is considering making a takeover bid for Company...

- Question 67: A venture capitalist invests in a company by means of buying...

- Question 68: Company ABC is planning to bid for company DDD, an unlisted ...

- Question 69: Select the most appropriate divided for each of the followin...

- Question 70: A listed company follows a policy of paying a constant divid...

- Question 71: Company A, a listed company, plans to acquire Company T, whi...

- Question 72: The ex div share price of a company's shares is $2.20. An in...

- Question 73: A company is located in a single country. The company manufa...

- Question 74: Company A has agreed to buy all the share capital of Company...

- Question 75: The Board of Directors of a listed company have decided that...

- Question 76: Company U has made a bid for the entire share capital of Com...

- Question 77: A company intends to sell one of its business units, Company...

- Question 78: A company is considering either directly exporting its produ...

- Question 79: Which THREE of the following long term changes are most like...

- Question 80: It is now 1 January 20X0. Company V, a private equity compan...

- Question 81: Company C has received an unwelcome takeover bid from Compan...

- Question 82: A private company manufactures goods for export, the goods a...

- Question 83: Company J is in negotiations to acquire Company K and believ...

- Question 84: A company is considering either exporting its product direct...

- Question 85: A company has a covenant on its 5% long-term bond, stipulati...

- Question 86: A company is currently all-equity financed with a cost of eq...

- Question 87: Two listed companies in the same industry are joining togeth...

- Question 88: RST wishes to raise at least $40 million of new equity by is...

- Question 89: A company's current earnings before interest and taxation ar...

- Question 90: A Venture Capital Fund currently holds a significant shareho...

- Question 91: Which of the following would be a reason for a company to ad...

- Question 92: The directors of a multinational group have decided to sell ...

- Question 93: Providers of debt finance often insist on covenants being en...

- Question 94: The following information relates to Company A's current cap...

- Question 95: Two unlisted companies TTT and YYY are being valued. The com...

- Question 96: A company's annual dividend has grown steadily at an annual ...

- Question 97: A company is financed by debt and equity and pays corporate ...

- Question 98: A company has undertaken a transaction with its shareholders...

- Question 99: A company is wholly equity funded. It has the following rele...

- Question 100: Select the most appropriate divided for each of the followin...

- Question 101: A company has: * 10 million $1 ordinary shares in issue * A ...

- Question 102: A company in country T is considering either exporting its p...

- Question 103: A new company was set up two years ago using the personal fi...

- Question 104: A company is deciding whether to offer a scrip dividend or a...

- Question 105: Company AD is planning to acquire Company DC. It is evaluati...

- Question 106: A company has an opportunity to invest in a positive net pre...

- Question 107: Assume today is 31 December 20X1. A listed mobile phone comp...

- Question 108: Which of the following statements is true of a spin-off (or ...

- Question 109: The Treasurer of Z intends to use interest rate options to s...

- Question 110: A listed publishing company owns a subsidiary company whose ...

- Question 111: Listed company R is in the process of making a cash offer fo...

- Question 112: Company A is proposing a rights issue to finance a new inves...

- Question 113: Company A is subject to a takeover bid from Company B, both ...

- Question 114: Company J plans to acquire Company K, an unlisted company wh...

- Question 115: Company A, a listed company, plans to acquire Company T, whi...

- Question 116: Listed company R is in the process of making a cash offer fo...

- Question 117: WW is a quoted manufacturing company. The Finance Director h...

- Question 118: A UK based company is considering investing GBP1 ,000,003 in...

- Question 119: The directors of the following four entities have been discu...

- Question 120: A company is considering a divestment via either a managemen...

- Question 121: Company J is in negotiations to acquire Company K and believ...

- Question 122: A geared and profitable company is evaluating the best metho...

- Question 123: Which THREE of the following non-financial objectives would ...

- Question 124: A company's Board of Directors is considering raising a long...

- Question 125: Company R is a well-established, unlisted, road freight comp...

- Question 126: On 31 October 20X3: * A company expected to agree a foreign ...

- Question 127: A company has stable earnings of S2 million and its shares a...

- Question 128: An aerospace company is planning to diversify into car manuf...

- Question 129: A listed company plans to raise $350 million to finance a ma...

- Question 130: XYZ has a variable rate loan of $200 million on which it is ...

- Question 131: A major energy company, GDE, generates and distributes elect...

- Question 132: Company C has received an unwelcome takeover bid from Compan...

- Question 133: A listed publishing company owns a subsidiary company whose ...

- Question 134: Company A is identical in all operating and risk characteris...

- Question 135: Hospital X provides free healthcare to all members of the co...

- Question 136: The table below shows the forecast for a company's next fina...

- Question 137: A company has announced a rights issue of 1 new share for ev...

[×]

Download PDF File

Enter your email address to download CIMA.CIMAPRA19-F03-1.v2023-03-06.q137.pdf